FILING BACK TAX RETURNS PHOENIX AZ

Tax Debt Advisors for Filing Back Tax Returns Phoenix AZ

It is important to remember that the IRS does not punish primarily for non payment but rather for non filing. The penalties for failing to file a tax return are 10 times greater than the penalty for non payment. That means the IRS is more interested in getting a paper return than paper money.

Most people fail to file because they don’t have the money to pay the tax. That’s like putting your head in the sand to save you from the IRS lion. If you file your returns on time you will save yourself lots of penalties and the IRS is much easier to work with if you have been filing each year. Once a client has failed to file for one year, the average client does not seek help until six years later. Why? Because it usually takes the IRS that long to levy their wages and/or bank accounts. If the IRS was much more aggressive and competent, clients would save thousands of dollars in penalties and interest.

If you have lost your records or they were destroyed in a fire or flood, it is possible to reconstruct the returns. The IRS keeps track of W-2 information, interest and dividends paid, home mortgage interest, sales of stock and any K-1 and retirement income information. Banks can provide copies of old bank statements and checks. With a little effort, most returns can be reasonably reconstructed. We always attach a note to the return explaining how we arrived at the numbers reported.

If absolutely no information is available, there is still an acceptable way for filing back tax returns Phoenix AZ. This is based on economic reality. We have a worksheet that determines how much you had to make to pay your bills every month. We can file a tax return based on estimates if the estimates are reasonable.

Filing Back Tax Returns to fix a nine year old debt.

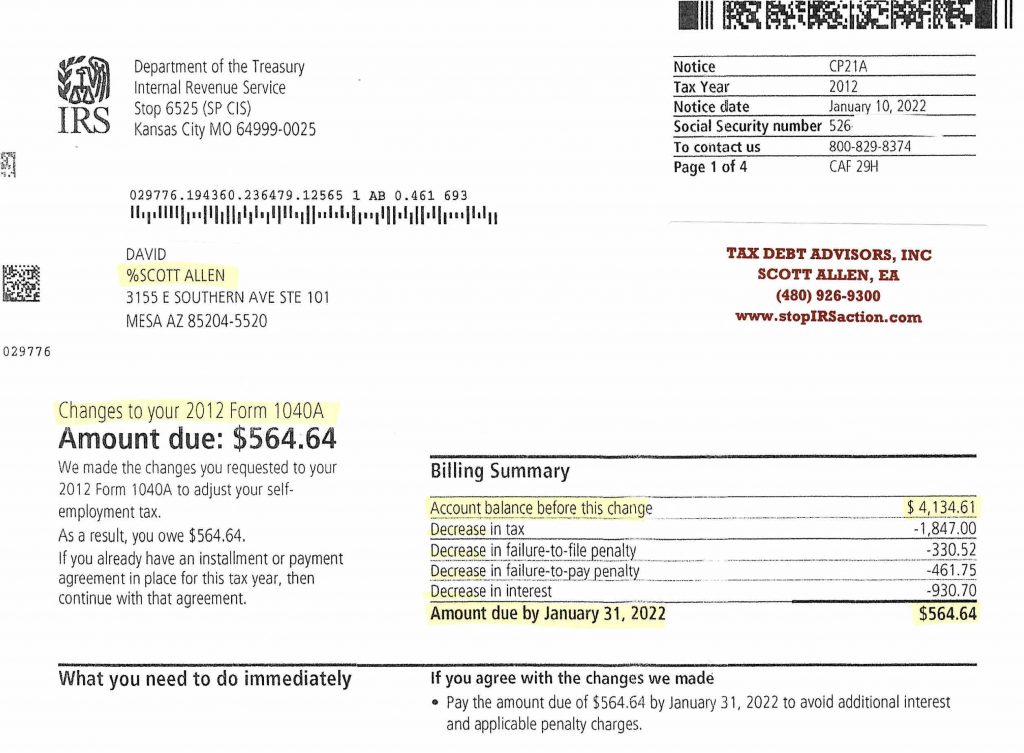

David owed the IRS for back taxes from 2012. They claimed he owed them over $4,000 on a tax return he never filed. How could this be so? The IRS went ahead and filed a tax return for him. This is called a substitute for return (SFR). The good news in all this is that David can still file a correct taxpayer filed return. That is exactly what Tax Debt Advisors, Inc did for him. As you can view from the notice below, the $4,000 debt was brought down to under $600. With the reduction in taxes owed, the interest and penalties were reduced for him as well.

Scott Allen E. A.

Tax Debt Advisors, Inc

Don’t fight the IRS alone if you need help filing back tax returns Phoenix AZ. Get the right local help. www.FileBackTaxes.net