Mesa AZ IRS CP2000 Audit

Getting the right help with a Mesa AZ IRS CP2000 Audit.

First off, what is a Mesa AZ IRS CP2000 audit? This is the most common for of an IRS audit. More CP2000 notices get sent out each year then probably just about any other audit notice. A CP2000 notice occurs when you file your tax return and what you report does not match up with what was reported to the IRS.

Example: You file your tax return with your W2 income and your capital gain income, but by mistake to forget report the money you withdrew early from your 401k.

When a scenario like this happens you will get a letter from the IRS letting you know they know about the early distribution from your 401k with a proposed amount of taxes owed. From here you have a couple options. You can accept and pay the additional taxes, you can protest their position, modify their assessment, or file an amended tax return. Just because you get a Mesa AZ IRS CP2000 notice does not mean the IRS is always right. They could be applying the additional tax bill incorrectly or your retirement company could have issued an incorrect statement by mistake.

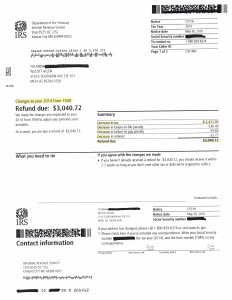

At the end of the day a CP2000 IRS notice is not the end of the world. You have plenty of time to challenge it or work out a payment arrangement on the additional taxes owed. If you find yourself opening up a Mesa AZ IRS CP2000 notice it could be best to have an Enrolled Agent represent you to walk you through the process. Scott Allen EA of Tax Debt Advisors specializes in helping taxpayers with their IRS problems whether it be an audit, unfiled tax returns, or dealing with collection matters. Below is a picture of a recent success by Scott Allen EA in challenging a clients CP2000 notice. Through the preparation of an amended tax return filing he reduced the IRS assessment by about $3,000 of tax, interest, and penalty.

If you feel it necessary consult with Scott Allen EA today in Mesa Arizona by calling 480-926-9300.