2018 Mesa IRS Settlement by Tax Debt Advisors

2018 Mesa IRS Settlement finalized

You may have come across this blog because you (like Michael) need a 2018 Mesa IRS Settlement. Let Tax Debt Advisors of Mesa Arizona be your representation. They can be your IRS Power of Attorney between you and the IRS. When there is a Power of Attorney on file the IRS is required by law to make verbal and in-person contact with them rather then you. Also, when the IRS sends any mail pertaining to collection activity it will be sent you and also the Power of Attorney on file.

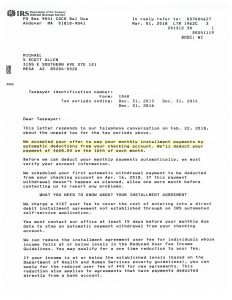

Michael was lost and confused on what to do to resolve his IRS matter. He made an attempt or two on is own but it was not getting anywhere. Michael wanted to set up a settlement with the IRS and also prevent the IRS from filing a federal tax lien. Tax Debt Advisors accomplished both. View the notice below.

For his settlement Michael agreed to a fixed monthly payment plan to settle his IRS debt. According to the agreement the IRS will no longer bother him or ask for additional financial information at a later date as long as he sticks to the terms. The terms are simple. File and pay any and all future tax returns on time without extensions. Any new debt that would come on board will automatically default the arrangement.

Call Scott Allen EA and setup a settlement with the IRS today. Don’t wait until its too late and the IRS is garnishing your wages or bank account.