Shhh…I am a Delinquent Taxpayer. Who do I call?

Mesa AZ IRS Tax Attorney ?

First, being a delinquent taxpayer is not a legal issue and does not require the help of a Mesa AZ IRS Tax Attorney. However, being a delinquent taxpayer can cause the IRS to close down your business, breakup marriages, damage your health, and cause many sleepless nights. Most taxpayers who miss filing one year for a “good reason” become paralyzed the following year and neglect to file a second year. Once the IRS has not contacted them, the fear of being contacted by the IRS and facing the problem is too much for most taxpayers. Most taxpayers fear the terrible penalties and interest the IRS adds to the tax liability and are unaware of IRS programs in place to help get taxpayers back in good standing. Many taxpayers ignore the IRS until their bank account or paychecks have been levied. Now taxpayers have to face their problem to keep their paycheck and sometimes even their job. Many times their first thought is that they need a Mesa AZ IRS tax attorney when in fact they don’t.

It is critical that you are certain that you are working with the right person to get you bank on track with the IRS. Work with someone like Scott Allen E.A. in Mesa AZ who has been successful at resolving hundreds of IRS tax debts. Scott can be reached for a private consultation at no cost. Call him today at 480-926-9300.

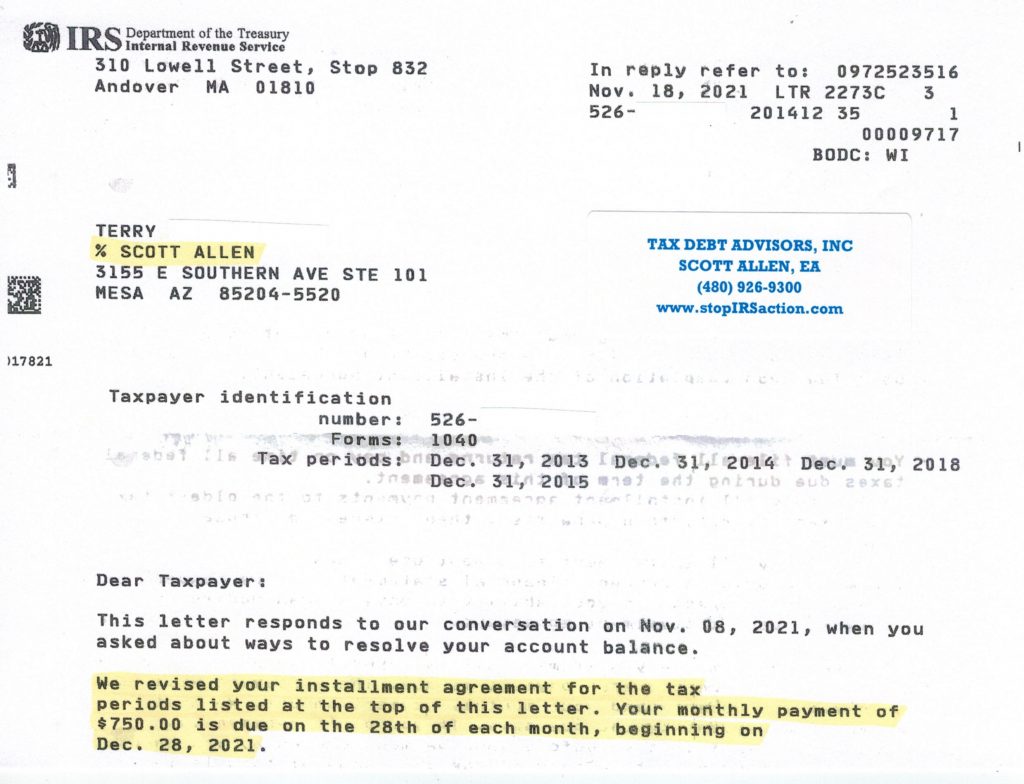

Terry was strapped with a monthly payment plan on her Mesa AZ IRS debt of over $1,500/month. She met with Scott Allen (an Enrolled Agent) who was able to reevaluate her financial situation and successful cut her monthly IRS payment in half. Now she is only paying $750/month due on the 28th of each month. (See IRS notice below).

If you feel like the IRS is taking advantage of you requiring you to pay more than you can afford give Scott Allen E.A. a call to discuss your options. He will let you know if there is a better settlement option available for you or if you are in the best possible plan with them.