Call Tax Debt Advisors if you receive a Tempe AZ IRS Notice of Intent to Levy

Tempe AZ IRS Notice of Intent to Levy

This notice from the IRS is warning you that they intend to levy your bank accounts or wages or both. The IRS is required to notify you before they take action. The IRS hopes that you will resolve your IRS debt or enter into a settlement before they take levy action. The IRS does not want to anger taxpayers but in really they are professional bill collectors. Tax Debt Advisors has help employees from many companies in Arizona including Wells Fargo Bank, Apollo Group and public employees such as Maricopa County and Arizona State University.

The IRS notice gives you 30 days before the IRS takes action. If you have a P. O. Box and only check your mail once a week or longer and have a Tempe AZ IRS problem, you are limiting the time you or your IRS representative has to take action. The most common settlement option is an IRS installment arrangement. Scott Allen E.A. of Tax Debt Advisors has negotiated many payment plans that allow his clients to pay their necessary living expenses and still satisfy the demands of the IRS. Tax Debt Advisors offers a free consultation and can be reached at 480-926-9300.

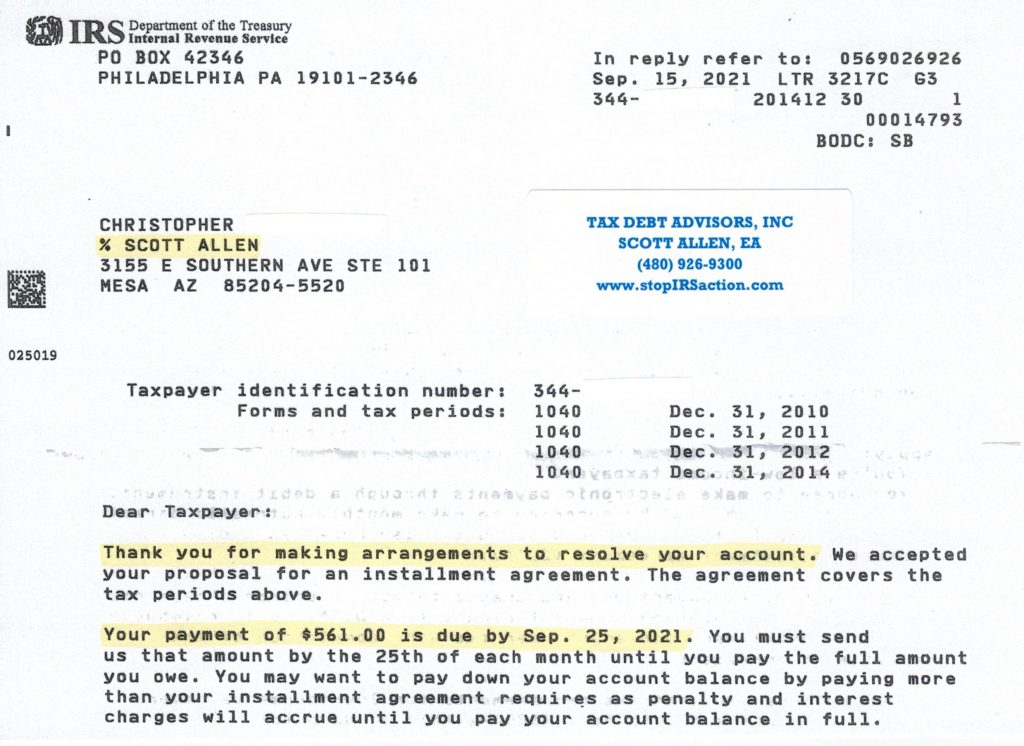

Avoid a Tempe AZ IRS notice of intent to levy by successfully negotiating a settlement with the IRS like Scott Allen EA did for his client Christopher. See the approved agreement below. By lumping all four tax years into one low monthly payment plan of $561 the IRS will leave him alone otherwise.