Tax Debt Advisors, Inc. knows Mesa AZ IRS Wage Garnishment Regulations

Mesa AZ IRS wage garnishment is the IRS most potent weapon to get taxpayer’s attention when tax liabilities have remain unpaid and the taxpayer is not in a settlement option with the IRS. Wage garnishments will take most of your paycheck. This is just the first step in the IRS attempt to collect the tax liability.

Before the Mesa AZ IRS wage garnishment notice goes to your employer, the IRS has made several attempts to notify you of their intentions. The IRS must first assess the tax liability. If you do not pay the amount owed or agree to a settlement option, the garnishment notice will be mailed to your employer.

The IRS really does not want to issue someone a Mesa AZ wage garnishment. They know that this is a burden for taxpayers and sets them up as the bad guy. They only do this as a last resort. When this happens you need to get serious about getting professional help. Scott Allen E.A. of Tax Debt Advisors, Inc. has the experience to end your Mesa AZ IRS wage garnishment.

Tax Debt Advisors, Inc. releases a Mesa AZ IRS wage garnishment

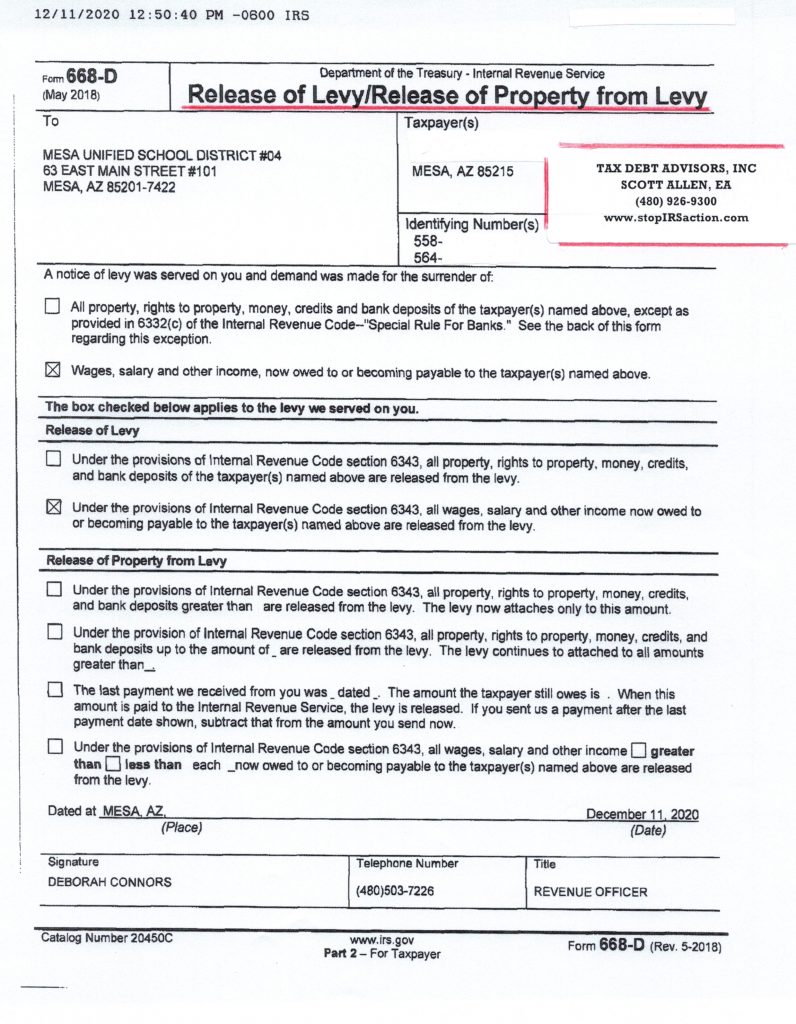

Scott Allen EA represented a taxpayer before the IRS who owed the IRS over $100,000 and needed their Mesa AZ IRS wage garnishment released. View the image below to see a copy of the wage levy release from the local IRS Revenue Officer assigned to the case.