Mesa AZ IRS Levy on Bank Account: Call 480-926-9300

Don’t endure a Mesa AZ IRS Levy any longer

Many taxpayers endure a Mesa AZ IRS levy of their bank account and assume that there is nothing they can do about it. Even worse is thinking the IRS will stop at that point. Don’t ignore a Mesa AZ IRS levy of your bank account because a levy against your wages is sure to follow. IRS tax liens and other IRS collection actions are just around the corner if they already haven’t occurred.

If you are serious about taking care of your IRS problems, get a professional on your side. Tax Debt Advisors of Mesa AZ has the expertise to help you with your IRS problems. Before Scott can help you he will need:

- A signed IRS Power of Attorney (Form 2848)

- Information about your finances—you income and living expenses

- Copies of bank account statements

- Paystubs with year-to-date earnings

- Copy of your last tax return

On occasion clients omit disclosing information. This is a big mistake as you will have to sign a disclosure that all of the information is true and complete under penalties of perjury. If you have Mesa AZ back tax returns that have not been filed these will have to be done prior to receiving any settlement with the IRS. Tax Debt Advisors will prepare returns within 48 hours after receiving all of the information. If you would like a free initial consultation, call 480-926-9300 to schedule an appointment.

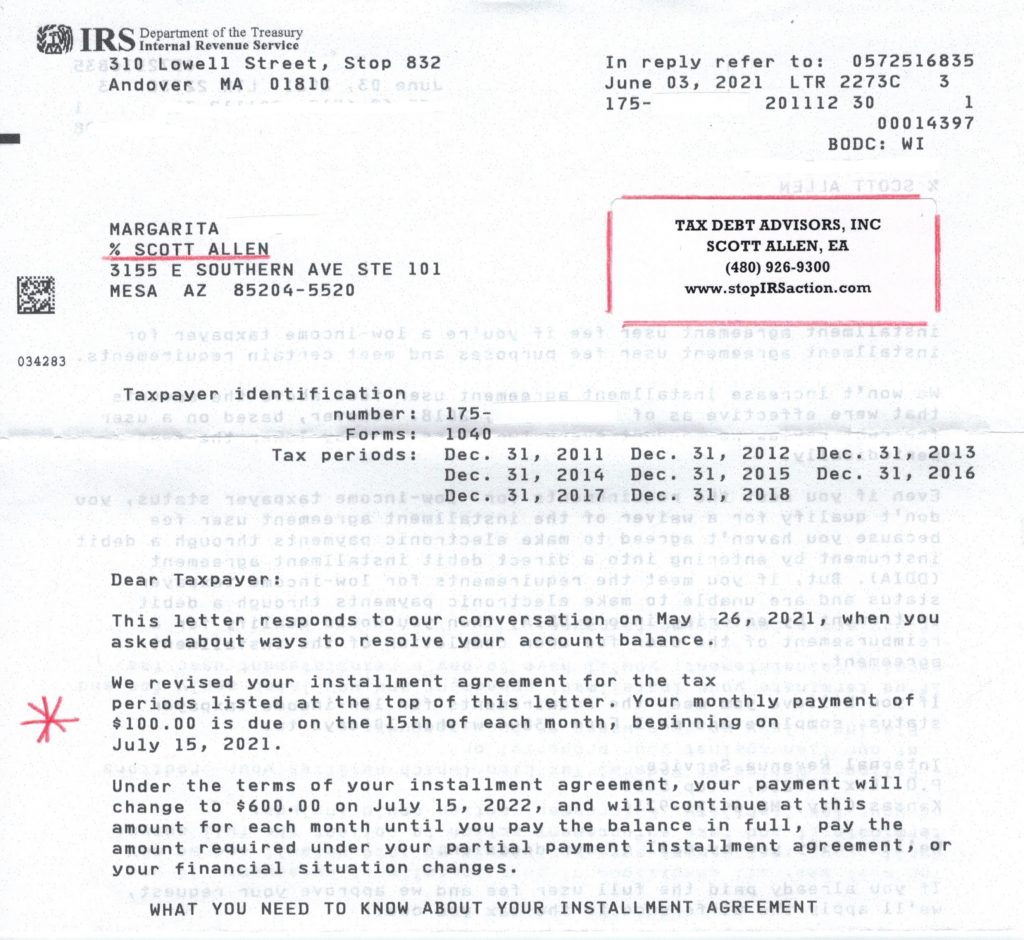

Scott Allen EA of Tax Debt Advisors stopped the following Mesa AZ IRS levy by negotiating a payment plan for his tax client. See the agreement below.

0