Setup Phoenix AZ IRS payment plan & no tax lien

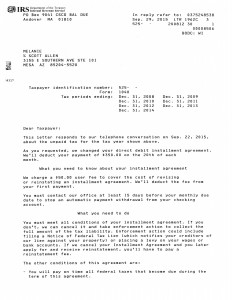

Just completed last week by Scott Allen EA of Tax Debt Advisors was this Phoenix AZ IRS payment plan. After getting her in compliance with all tax returns a successful payment plan was negotiated on her behalf.

Tax Debt Advisors specializes in dealing with all types of IRS collection matters. One of those areas is a Phoenix AZ IRS payment plan. Many clients fit into that area as their best alternative to get a settlement established with the IRS. When Scott Allen EA meets with you he will go over all IRS settlement options available to you to help select the best one for you. Other options could be a currently non collectible status or an offer in compromise. Some Clients will utilize bankruptcy as their best option.

To properly evaluate your options with the IRS Scott Allen EA will need to gather up all your financial information (i.e. proof of income and expenses). With this information he then can look at the area you qualify for but also the areas you do not qualify for. Some potential clients come in to meet with Scott Allen EA telling him what settlement they want. It doesn’t always work that way. If Scott Allen EA knows up front that a solution you are expecting will not work he won’t lead you on. He promises straight answers and follow through service.

If you are in need to renegotiating your IRS settlement or just looking to get started contact Tax Debt Advisors near Phoenix AZ today.