IRS Settlement in Mesa AZ: Case Closed

Can you qualify to get your “Case Closed”?

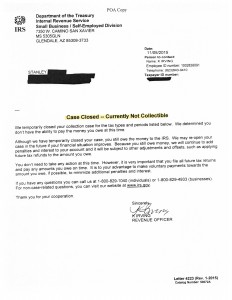

Congratulations to Stanley who was able to get his IRS settlement in Mesa AZ completed with help from Tax Debt Advisors. The image below shows the acceptance from the IRS of getting Stanley’s IRS debt into a currently non collectible status.

Because Stanley is in a currently non collectible status he does not have to pay a single dollar on his prior IRS debt. Yes, there are conditions. The conditions are to file his future tax returns on time and to pay his future taxes owed on time. Scott Allen EA helps keep Stanley in compliance every year by using his services for yearly tax preparation. Every year Scott and Stanley are able to update each other about his current situation and evaluate his IRS settlement in Mesa AZ to see if its still the best option for him. An IRS settlement does not have to be a permanent solution and better options may become available. Its important to use an IRS Power of Attorney who stays current with the new laws and regulations of the IRS on a yearly basis. Scott Allen EA of Tax Debt Advisors does exactly that.

Put his experience to work for you. If you have an IRS delinquency that needs attention, meet with Scott Allen EA for a free consultation. If there are ways he can assist you if will show you that. If there is nothing he can do to assist you he will let you know that as well. Scott Allen EA does not want to take on your case unless it is in your best interest…PERIOD.