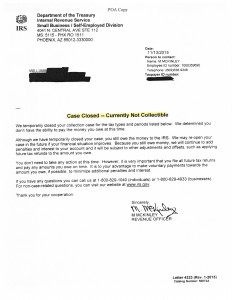

IRS settlement in Scottsdale AZ: Case Closed

Doesn’t everyone want their case closed with the IRS?

For further information or to contact Tax Debt Advisors go to their full website. Learn what needs to be done to get an IRS settlement in Scottsdale AZ.

William was and is a client of Scott Allen EA. He came in to see Scott with an IRS agent assigned to his case with levies on all his bank accounts and his main sources of income. William had not filed tax returns since 2003. In addition to that the IRS had filed six years worth of tax returns for him causing his debt to the IRS to be inflated by about 500%. With Scott Allen EA as William’s IRS power of attorney he was able to get in contact with the IRS revenue officer and work out deadlines and commitments to getting the taxpayer back in compliance. She stopped all future collection activity and that remained in place as long they kept their commitments. After getting William caught back up on his tax filings through 2014 and providing up-to-date financial information it was determined by Scott Allen EA that he would qualify for a currently non collectible status for all of his IRS debt. Upon negotiating that with the IRS that is exactly what was approved. Another “Case Closed” for Tax Debt Advisors. The letter above is actual evidence that Scott Allen EA follows through and is successful in negotiating an IRS settlement in Scottsdale AZ.

To find out what Scott Allen EA can do for you by way of an IRS settlement give him a call today.