Get your IRS settlement in Chandler AZ finalized.

Why are you delaying your IRS settlement in Chandler AZ?

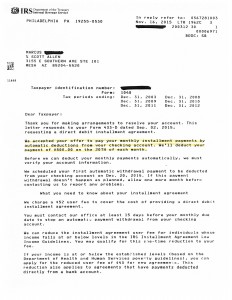

Don’t do what Marcus did which was putting off his IRS settlement in Chandler AZ too long to the point where his wages were being garnished by the IRS. Before meeting with Tax Debt Advisors Marcus had not filed taxes in over 10 years. View the image below to see the agreement that Scott Allen EA of Tax Debt Advisors was able to negotiate after getting Marcus all caught up with his unfiled tax returns. Based upon a detailed reconstruction of his financial information he is on a fixed $500/month payment plan to satisfy the IRS. As long as he does not incur future IRS debt the IRS agrees to leave him alone. He is not at threat of anymore levies or garnishments. To see other Tax Debt Advisors successes click here.

Below are the three steps to be taken to be able to settle your IRS debt.

Below are the six different options available to settle your IRS debt.

1. Let it expire

2. Suspend it

3. Adjust it

4. Pay it

5. Compromise it

6. Discharge it

To meet with Scott Allen EA and have him represent you throughout the entire process call him at 480.926.9300. He will meet with you (and your spouse) for a free initial consultation.