Click here for Mesa AZ unfiled tax returns

Scott Allen EA helps with Mesa AZ unfiled tax returns

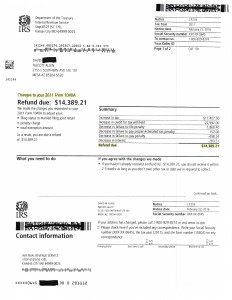

Tax Debt Advisors is the East Valley leader in Mesa, AZ for unfiled tax returns. His company specializes in the preparation of delinquent tax returns and getting taxpayers back in the system again. If you desire marriage without financial stress, home ownership, bank accounts, or to start saving again for your retirement contact Tax Debt Advisors today. They have been preparing Mesa AZ unfiled tax returns since 1977. Attached is just a recent example of a success accomplished for their client David who had not filed tax returns for five years. Click on the image below to view or click here for more information on unfiled tax returns.

Where do I start?

Start by meeting for a free initial consultation with Scott Allen EA of Tax Debt Advisors. He will sit down with you for 30-45 minutes and breakdown the entire resolution process. After meeting with him you will understand all the necessary steps needed to accomplish your goals. Don’t get overwhelmed in the process but rather if you just face each step as it comes to you it will be over before you know it.

As your IRS power of attorney you will be represented before them in all Mesa AZ unfiled tax returns and IRS settlement options. Don’t go at this alone but rather with a local representative who can guide through the entire process. CAUTION: Be leery of promises made by out of state companies who advertise IRS resolution work. Often times they make unrealistic promises to get your business. You want to be able to meet face-to-face with the person you hire. Scott Allen EA does not sell you; he works with you step by step and will not give you unrealistic promises. Speak with him today.

August 2018 update:

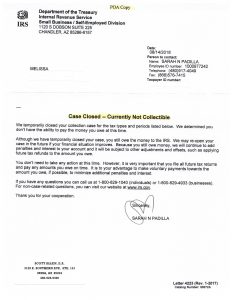

A recent success story for Scott Allen EA and Mesa AZ unfiled tax returns. Melissa was able to get all of her unfiled tax returns prepared and filed through Scott. Upon completion of those returns a “Case Closed – Currently Non Collectible” status was negotiated for all her back IRS debt. Melissa is not required to pay a dime on her back tax debt as long as she remains in filing and paying compliance on all future tax filings. See the IRS approval notice below.

To see what options are available for you to resolve your IRS debt speak with Scott Allen EA today. He will make today a great day for you!