Enrolled Agent vs Chandler AZ IRS Tax Attorney

Chandler AZ IRS Tax Attorney for IRS settlement. Really???

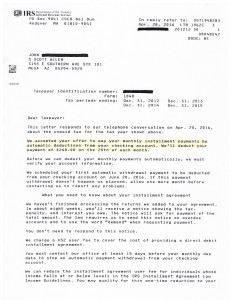

Where did John turn to for his IRS negotiation work? If it was not a Chandler AZ IRS Tax Attorney, who was it? John became acquainted with Scott Allen EA of Tax Debt Advisors, Inc. As an Enrolled Agent Scott successfully represented John and his wife with their IRS settlement. View the settlement acceptance letter below and see for yourself. Don’t fall into the trap of thinking you have to use a tax attorney for your particular case. 98% of IRS debt matters can be handled by a CPA, EA, or even yourself.

John came into the situation four years behind on his tax return filings. Before a settlement was able to be negotiated all four tax returns had to be filed first. In the initial contact with the IRS, Scott Allen EA was able to pull any and all records they had on John as far as, W2’s, 1099’s, stock sales, mortgage interest, etc. This is to match the IRS records with Johns’s and also to make sure they don’t forget to report any income activity the IRS knows about. This drastically reduces the odds of getting audited. Once all that information was compiled they went through the preparations one year at a time. While this is being accomplished Scott Allen EA had also secured a hold on all collection activity. Next, they began the process of a payment plan settlement. With the payment plan intact the IRS will not file any levies or garnishments against any bank accounts or paychecks.

To protect your bank accounts and paychecks from the IRS contact Tax Debt Advisors today. He can file all your back tax returns even if you don’t have any records. Whether it be a payment plan, non collectible status, offer in compromise, or qualifying your taxes for bankruptcy Scott Allen EA will go to battle for you. Don’t put it off any longer and get the best settlement allowable by law.

Success in 2019 without using a Chandler AZ IRS Tax Attorney

Many taxpayers believe only a Chandler AZ IRS tax attorney can fight the IRS for you. While they can, so can Enrolled Agents. Scott Allen is a licensed Enrolled Agent that can represent you before the IRS in matters of collections, audits, and tax preparation. If you have a need involving an IRS problem give Scott Allen EA a call today.

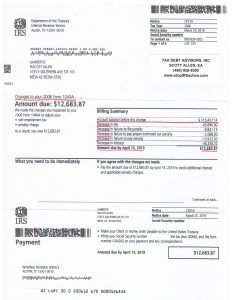

See what he did recently for a client where the IRS assessed him a tax bill for over $115,000 for 2006. Scott was able to protest their assessment with a proper and accurate appeal and wipe out the majority of the debt.

Consult with Scott Allen EA today to discuss your options to deal with the IRS. He will help you navigate the best course of action whether that involves the need to hire him or not.