Phoenix AZ IRS Offer in Compromise

Completed and approved Phoenix AZ IRS Offer in Compromise

Congratulation to Michael on his successful Phoenix AZ IRS Offer in Compromise. The process took about 14 months from start to finish but when you can settle your $445,000 IRS debt for about $22,000 in total it would be considered a great day. That is the kind of day Michael had. The IRS will consider an Offer when the amount offered represents the most they can expect to collect within a reasonable period of time. A reasonable period of time to the IRS varies in each individual case but its typically the remaining amount of time left to collect the debt. The IRS has a ten year period to collect a debt from when the tax return was filed. Each tax year will have its own expiration date. It important to understand that not everyone qualifies for an IRS offer and it may not be the best available option for everyone either. What if Michael’s IRS debt was only 9 months away from expiring? Scott Allen EA would not have prepared and submitted an IRS offer. He would have negotiated a non collectible status or minimal payment plan and let the debt expire. It would have been a easier and cheaper option for him all around. Because Michael still had 7.5 years left remaining on his statute they elected to go the Phoenix AZ IRS Offer in Compromise route.

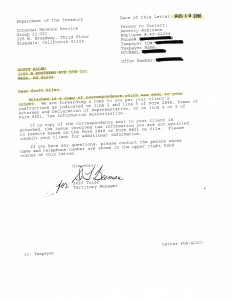

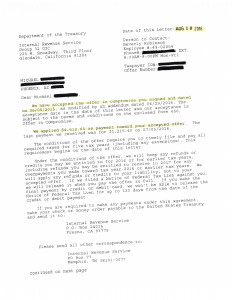

To see what an IRS Offer in Compromise acceptance letter looks like view the images below.

Scott Allen EA of Tax Debt Advisors is a family owned and operated business in the greater Phoenix area. His tax practice specializes in the negotiation of IRS settlements whether it be a payment plan, non collectible status, offer in compromise, appeals and abatement, or qualifying for bankruptcy. Its important that the person you hire to be your power of attorney is comfortable with all these settlements and can properly advise and qualify you for one. To sit down with Scott Allen EA pick up your phone and schedule a consultation with him. He will make today a great day for you.