Tax Debt Advisors negotiates a payment plan

Have your IRS payment plan negotiated by Tax Debt Advisors

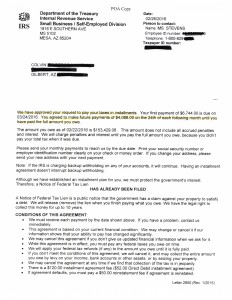

Don’t let the payment plan amount scare you that you see in the notice below. This is a married couple who have an annual income of over $325,000. When they first met with Tax Debt Advisors they owed the IRS over $800,000. Through the process of tax preparation and audit reconsideration the total overall debt was reduced to $153,000 as you can see by clicking on the image below.

Tax Debt Advisors has represented and negotiated IRS payment plans for taxpayers since 1977. If you find yourself behind on some back tax returns, facing a IRS levy or wage garnishment, or need to set up a payment plan (or other IRS settlement) contact Tax Debt Advisors right now. Now is the time to be proactive rather then reactive. A much healthier settlement can be established when you “hold the chips”. Once the IRS starts a wage garnishment or bank levy they become in control and you have to react at that point. If you are currently under one of those actions there are some ways to reduce or stop the levy. Speak with Scott Allen EA of Tax Debt Advisors to discuss your case.

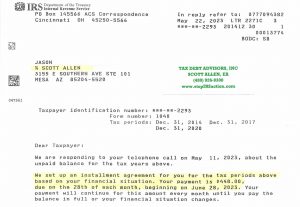

IRS payment plan negotiated in 2023

Jason and his wife were behind on a few years of back tax returns and needed an IRS payment plan negotiated by Tax Debt Advisors. After they prepared the missing returns to get the taxpayer’s filing compliant an aggressive payment plan was established. Click on the IRS notice below. This is actual work performed by Scott Allen EA of Tax Debt Advisors. The IRS is off their back and they are making a low $448 per month payment plan. If you live in Arizona and need to file back tax returns or negotiate IRS debt give him a call today. He will represent you from start to finish. Every case is unique and can have a different outcome but Scott will make sure you have the best possible settlement that the law will allow.