Gilbert AZ IRS Offer in Compromise

Settle over $55,000 of IRS debt in a Gilbert AZ IRS Offer in Compromise

Applying for a Gilbert AZ IRS Offer in Compromise is one of several different options to settle a debt with the IRS. Anthony came in to meet with Scott Allen EA to discuss all available options. You can read more on those settlement options by clicking here. Anthony first needed to get himself into compliance. There are two key components to compliance. First, all tax returns need to be filed. The IRS will throw out any settlement if this is not done. Also, only you do one settlement for all IRS debt. Second, to offer up a settlement with the IRS you have to have proper withholdings if you are an employee or be making quarterly estimated tax payments if you are self employed. Anthony is self employed so we set him up on making those estimated tax payments.

After these steps an evaluation was done on his current financial status. Everything was looked at from his income and expenses along with his debts and assets. It was determined that he could be a strong candidate for an offer in compromise. This is actually rare because most people that have an IRS debt are not a candidate for several reasons. Common reasons for not qualifying for an offer include too high of household income, too many assets, or “luxury” expenses being paid out.

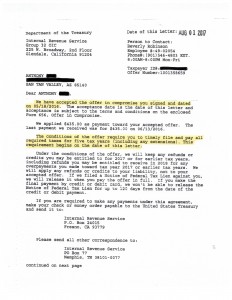

The application process was started, information was compiled, and an offer was proposed. The Gilbert AZ IRS offer in compromise was submitted for $2,172.00. Yes, that is a settlement of about 4 cents on the dollar. The offer was submitted in May 2016 and accepted by the Internal Revenue Service August 2017. It is the norm to have offer in compromises’s take 12-18 months to be approved. View Anthony’s acceptance letter below. Congratulations Anthony!

If you are ready to resolve your IRS debt contact Scott Allen EA of Tax Debt Advisors so he can explore and find the right solution for you. He will meet with you for a free consultation. He will make today a great day for you.