Tax Debt Advisors can Stop IRS Levy in Arizona

How to Stop IRS Levy in Arizona ?

If you need to stop IRS levy in Arizona it is important to react promptly. The IRS will move towards levy or garnishment action as a last resort if they feel there is no other option and the taxpayer isn’t being responsive. This is where hiring the right professional to be on your side will help. Tax Debt Advisors is a family company trained to specifically handle serious IRS cases that involves back taxes owed, unfiled tax returns, and negotiating settlements.

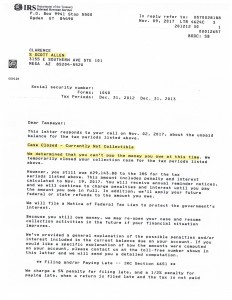

Stop the Internal Revenue Service before they put a stop to your wages. Clarence was in serious threat of an IRS levy. All of his back and current taxes were filed, he just needed to negotiate a settlement with them ASAP. Tax Debt Advisors was able to get Clarence into a Currently Non Collectible Status to resolve his debt. The IRS stopped all collection activity, and his income and bank accounts are free of IRS levy. See the IRS approval letter below.

What is the ultimate goal to stop IRS levy in Arizona? Simply, you want to get your overall account with the IRS in compliance. Compliance means to things: all required tax returns are filed and you are up to date on your current tax payments. Being up to date means that you are having proper withholding’s if you are an employee or making estimated tax payments if you are self employed.

Hire Scott Allen EA of Tax Debt Advisors to get you in compliance with the IRS. He can represent you and walk you through the entire process from beginning to end. Need help preparing any tax returns? He can do that too. Don’t delay any longer and give Scott a call. Clarence did and he didn’t regret that decision.