Tax Debt Advisors, Inc.—What do I do if I can’t afford my Glendale AZ IRS payment plan?

We will help you with your Glendale AZ IRS payment plan

This is very common that a taxpayer enters into an installment arrangement knowing that it was probably more than they could afford. Or, if a spouse loses a job or income is reduced by your employer or business, then you need professional help to get you into a settlement to resolve your tax debt but also allow you to pay your necessary living expenses. Sometimes a Glendale AZ IRS payment plan needs to be renegotiated or it’s just the wrong settlement option for you. Perhaps you need to file an Offer in Compromise or eliminate the taxes in a Chapter 7 tax motivated bankruptcy.

Scott Allen E.A. near Glendale Arizona has the experience to guide you towards the right settlement option and can negotiate with the IRS on your behalf. Tax Debt Advisors, Inc. has helped thousands of taxpayers since 1977. To schedule a free initial consultation with Scott Allen E.A., call him at 480-926-9300.

Case Update:

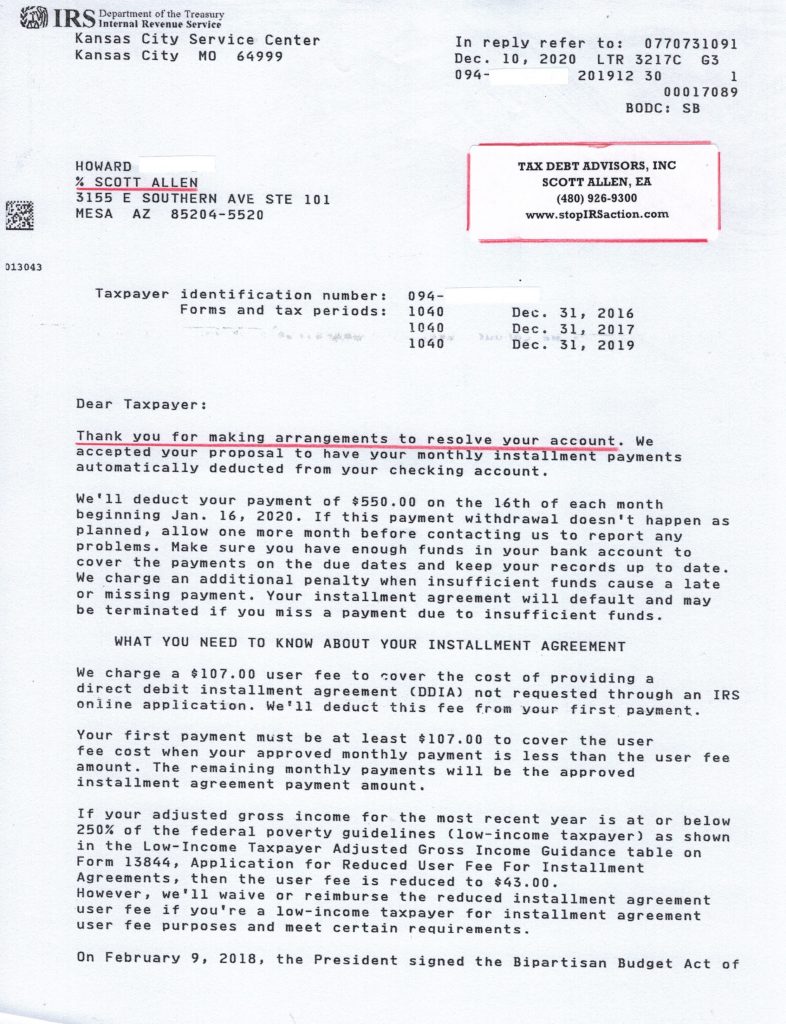

Scott Allen E.A. helped Howard find the best possible settlement option for him. It was determined that he was not a viable candidate for an IRS offer in compromise but rather qualified for a low monthly Glendale AZ IRS payment plan of $550/month. To see the work accomplished by Scott Allen E.A. on this case view the approval letter below from the IRS.