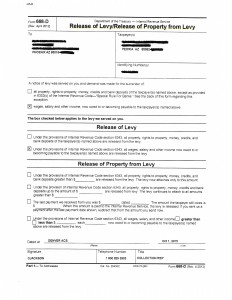

Another Chandler AZ IRS levy release

Scott Allen EA just completed a Chandler AZ IRS levy release for another client. Dominic was referred to Tax Debt Advisors by his employer who used their services about five years previous.

Stop putting the IRS in control of your finances right now. If you find yourself behind on your taxes with either unfiled tax returns or back taxes owed now is the time to work towards a resolution. If you owe the IRS on back taxes they have the legal right to place a levy or garnishment on your back account or wages. Tax Debt Advisors knows what it takes to get the job done. The process to get to a Chandler AZ IRS levy release starts with giving Scott Allen EA a Power of Attorney to represent you. The first thing Scott will do is “XRAY” your account with the IRS and what it will take to get you in compliance with them. This will get you a hold on all future collection activity and discover what needs to be done to release the IRS levy or stop the IRS levy from happening.

If you have unfiled tax returns that need to be prepared Scott Allen EA can assist in that entire process. He will help gather as much information as possible from the IRS along with helping you organize your records on your end.

After the back tax returns are prepared then the IRS will listen to your proposal of a settlement arrangement with them. There are several different types of settlement options with the IRS and based upon your current financial situation and how much you owe the IRS will play into what you qualify for. Many clients want to tell Scott what option they want him to do. It does not always work out that way; rather you have to be able to support your case within the internal revenue code.

If you are in need of a Chandler AZ IRS levy release make Tax Debt Advisors your first choice. They have been representing Arizona taxpayers just like you for two generations.