Arizona IRS Payment Plan for $25 a month

Is a $25 a month Arizona IRS payment plan even possible?

When someone sits down to meet with Scott Allen EA about an Arizona IRS payment plan the first thing they want to know is, what percentage with the IRS settle my debt for? This is really not the right question to ask. The IRS does not settle IRS debts in a payment plan or offer in compromise within a certain percentage range. They base a settlement on your current financial information. Typically the last 3-6 months if you are an employee and potentially the last 6-12 months if you are self employed. This is why is it extremely critical to have the right professional represent you before the Internal Revenue Service so that you can properly gather up all your financial information in the most advantageous (and legal) way possible. Planning in advance is key!

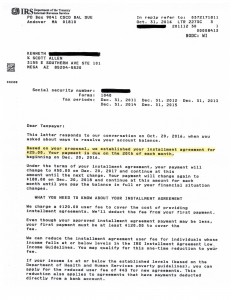

Ken is a great example of planning in advance to maximize his results. In the very first meeting he would have laughed at the idea of the IRS accepting a $25/month payment plan. However, if you click on the image below you can view the accepted Arizona IRS payment plan. This isn’t to say you can qualify for the same or even a similar agreement but it does say that Scott Allen EA of Tax Debt Advisors will negotiate for you and get you the BEST POSSIBLE IRS SETTLEMENT ALLOWABLE BY LAW. Options can include, a non collectible status, payment plan, offer in compromise, tax motivated bankruptcy, innocent spouse, SFR protests, or battling your case with appeals.

Meet with Scott Allen EA to find out the best course of action for you. Let him represent you by signing over an IRS Power of Attorney so he can speak to the IRS in your behalf from step one to the final resolution.