Arizona Tax Return Amendment

Arizona Tax Return Amendment: 2017

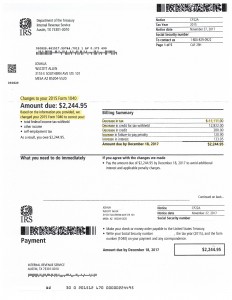

Often times taxpayers will find themselves in need of an Arizona tax return amendment filing. This can occur for reasons such as, a simple mistake, lost records, forgetting to report income, or identity theft. If the IRS catches the error before you they can notify you in a couple different ways. One way is by selecting your tax return for an audit. When this happens you are given a deadline to provide the requested information to them to support your deductions (or whatever is being challenged). Another avenue the IRS can question what your filed is by mailing you a CP2000 notice. This is a bit different then an audit. This letter is to inform you that different information was reported to them then what was claimed on the tax return filing. You are given a lengthy period of time to address this issue. Your options are to agree to the IRS’s findings or to challenge it. One form of challenging it is to prepare an amended tax return. This is what Tax Debt Advisors did for Josh. View the notice below and you can see that by protesting the IRS CP2000 notice we reduced their findings by over $11,000.

When faced with a challenge before the IRS its important to hire something is experience in dealing with a similar issue. Meet with Scott Allen EA of Tax Debt Advisors to determine if he is the right fit to handle your case. He will meet with you for a free consultation.