Biggest Challenge of Filing a Chandler AZ IRS Offer in Compromise (OIC)

Chandler AZ IRS Offer in Compromise

So when it comes to qualifying for a Chandler AZ IRS offer in compromise, don’t be discouraged thinking you have missed out on the best option. The Good news is that most of the time the best option is not an OIC. That is why you need a trusted Arizona professional who knows all the options and is working for your best interest not theirs and that includes theirs (the IRS). Scott Allen E.A. of Tax Debt Advisors, Inc. has the experience and is worthy of your trust. Tax Debt Advisors, Inc. has been helping taxpayers for over 40 years—since 1977. If you desire a free initial consultation, call 480-926-9300. Scott Allen E.A. will make that day a great day for you!

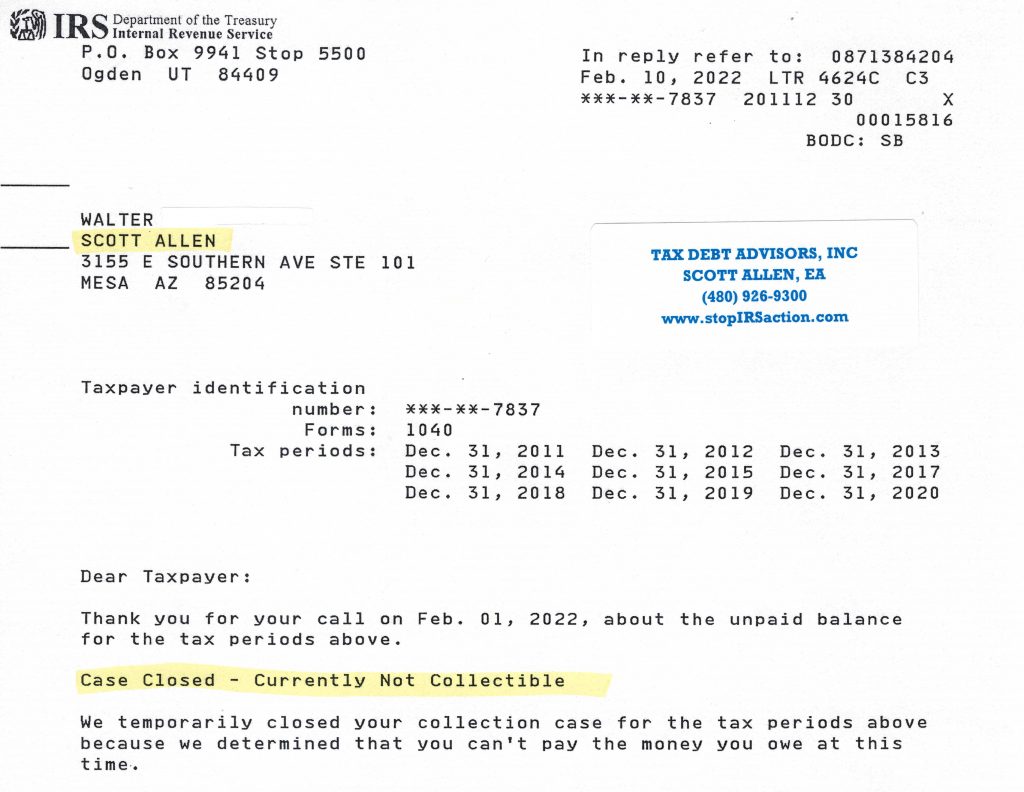

However, sometimes submitted a Chandler AZ IRS offer in compromise isn’t in the best interest of a client. Luckily there is more than one option for a taxpayer to settle an IRS debt. One of those options is a currently non collectible statues. When a taxpayer qualifies for this option they do not have to make any payments at all on their back taxes. This can be a permanent or a temporary solution depending on their current financial status. Walter is a client of Tax Debt Advisors and this is what was negotiated for him to solve his back taxes. All nine years of his back taxes owed are compliant with the IRS now. Below is a copy of the settlement agreement.