Chandler AZ Defaulted IRS Payment Plan

Oh no! A Chandler AZ defaulted IRS payment plan

Do not panic if you have a Chandler AZ defaulted IRS payment plan. For various reason an IRS payment can can enter default. Either a taxpayer misses a payment, late on a payment, or adds additional debt to the account. The IRS can also trigger a default of the agreement by doing a periodic review of the account every 2-4 years.

If you find yourself in one of these categories consider calling Scott Allen EA today to discuss your options. He will do a complete overview of your account with the IRS to determine your best option. Just because you have been in a payment plan with the IRS for the last three years does not mean it is still the best option for you today. It is important to look at options such as bankruptcy or an offer in compromise. IRS tax debts have expiration dates. Have Scott Allen EA let you know when your debt expires!

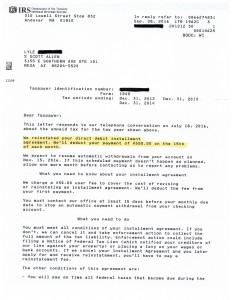

Once it has been determined what option is best to settle your Chandler AZ defaulted IRS payment plan, Scott of Tax Debt Advisors will get it done for you. See a recent Tax Debt Advisors review of an actual accomplishment of his. This was a taxpayer who had defaulted his agreement and Scott was able to file his missing tax return and re-work a new payment plan for him.