Derek’s Mesa IRS Settlement

Derek’s Mesa IRS Settlement 2018

Just completed this month by Tax Debt Advisors was Derek’s Mesa IRS settlement. Derek owes the IRS over $70,000 in back taxes. All the tax returns were filed for compliance purposes, he just couldn’t afford to pay them. Luckily by filing the tax returns timely he saved himself from the 25% late filing penalty the IRS charges.

Derek and Scott met for a consultation to evaluate and discuss his options to settle his debt with the Internal Revenue Service. Based upon his current income and expenses it was quickly noted that for right now he was not a viable candidate for an offer in compromise. On a side note, its important to remember and realize that only about 3% of taxpayers qualify for an offer in compromise to begin with. It’s very important to find that out before submitting an Offer. Offers are expensive to do and take a lot of time (about 12-18 months). You will want to be sure to explore all other options first.

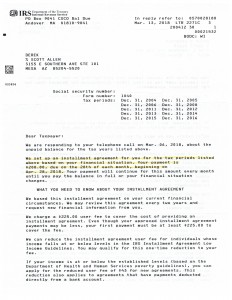

As you can see by clicking on the link below that Derek’s Mesa IRS settlement was an installment arrangement. Tax Debt Advisors was able to settle his debt in a low monthly payment plan of only $200 per month. The most important requirement is that he remembers to file and full pay his future tax liabilities on time so the agreement does not default.

If you need assistance in evaluating and negotiating IRS debt, file back tax returns, or just need a new tax preparer please call the office of Tax Debt Advisors and schedule a time to talk with Scott Allen EA today.