Do I Need a Peoria IRS Tax Attorney when I have no money to pay the IRS?

Peoria IRS Tax Attorney needed ?

The answer is no.

If you truly cannot pay the IRS any money on a monthly basis you would qualify for a currently non-collectible status (CNC). Extensive financial proof will need to be submitted to prove that you are truly in a hardship and the situation is not temporary. It is a relief to not have to make a monthly payment to the IRS but the debt is still there and interest and penalties are being added on a daily basis. If you qualify for CNC status you should have an IRS professional determine if you can file an Offer in Compromise under the option—Doubt as to Collectability.

If you have assets that can be liquidated, the IRS will require that they be sold and the funds received used towards your IRS debt. An example would be stocks or bonds. If you can borrow from your 401k, you will be required to borrow and use those funds to pay down your IRS debt if you choose to do an OIC.

These options are complicated and difficult to explain without having your specific financial information. Scott Allen E.A. provides a free consultation to discuss what you will need to provide him to help you decide the best way to resolve your tax debt. Call Scott at 480-926-9300 and he will provide you the solution and peace of mind you are seeking. Instead of panicking and calling a Peoria IRS tax attorney, make the right choice and hire Scott Allen EA (Enrolled Agent) as your IRS power of attorney representative.

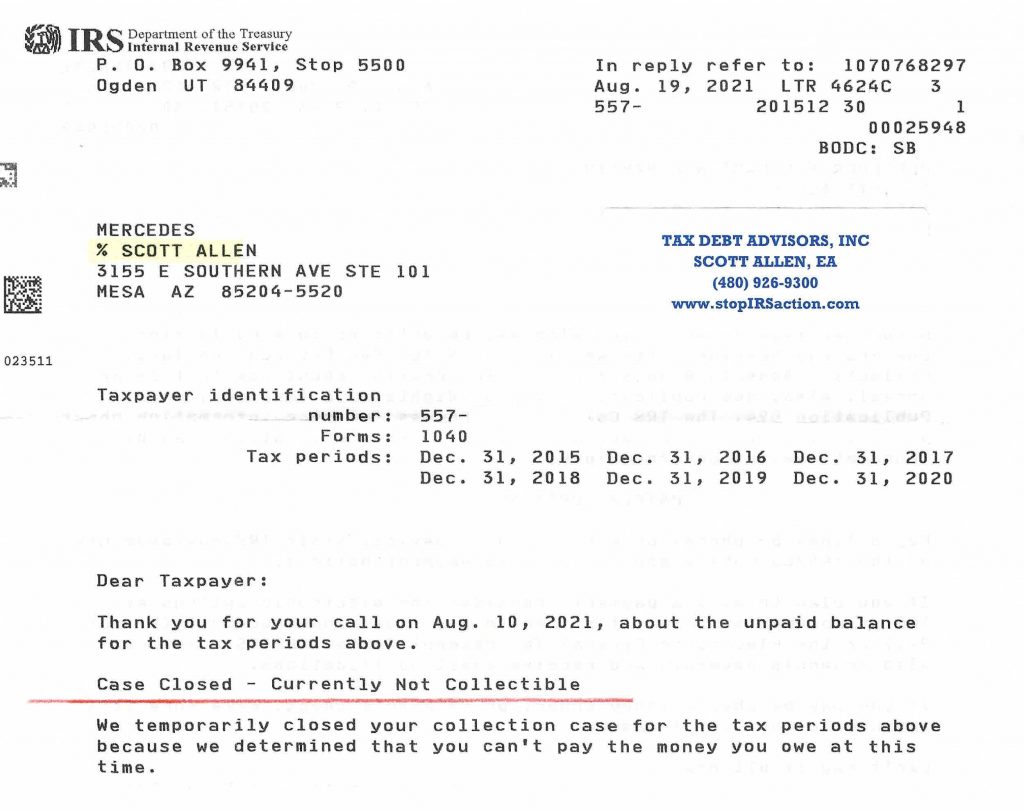

Currently Non-Collectible Status negotiated!

Mercedes and her husband were in dire need to an aggressive negotiation with the IRS. They called Scott Allen EA and got that relief. Don’t take our word for it but read the actually approval letter from the IRS below. Six years of IRS debt negotiated into a low $0.00/month payment plan.