Do I Need a Scottsdale AZ IRS Tax Attorney When I Receive a Notice of Federal Tax Lien?

Scottsdale AZ IRS Tax Attorney

No, this is not a legal matter. If you received an IRS Notice of Federal Tax Lien you have 30 days from the date of the notice to file IRS Form 12153 to request a Collection Due Process (CDP) hearing.

The CDP hearing is your chance to explain to an Appeals Officer why a tax lien should not have been filed. Scott Allen E.A. has expertise in meeting with an Appeals Officer regarding tax liens. Scott will first meet with you for a free consultation to determine if you should or need to request a CDP hearing. Scott Allen E.A. can be reached at 480-926-9300.

Before making a decision on what to do with a Notice of Federal Tax Lien consider calling Scott Allen at Tax Debt Advisors over a Scottsdale AZ IRS Tax Attorney.

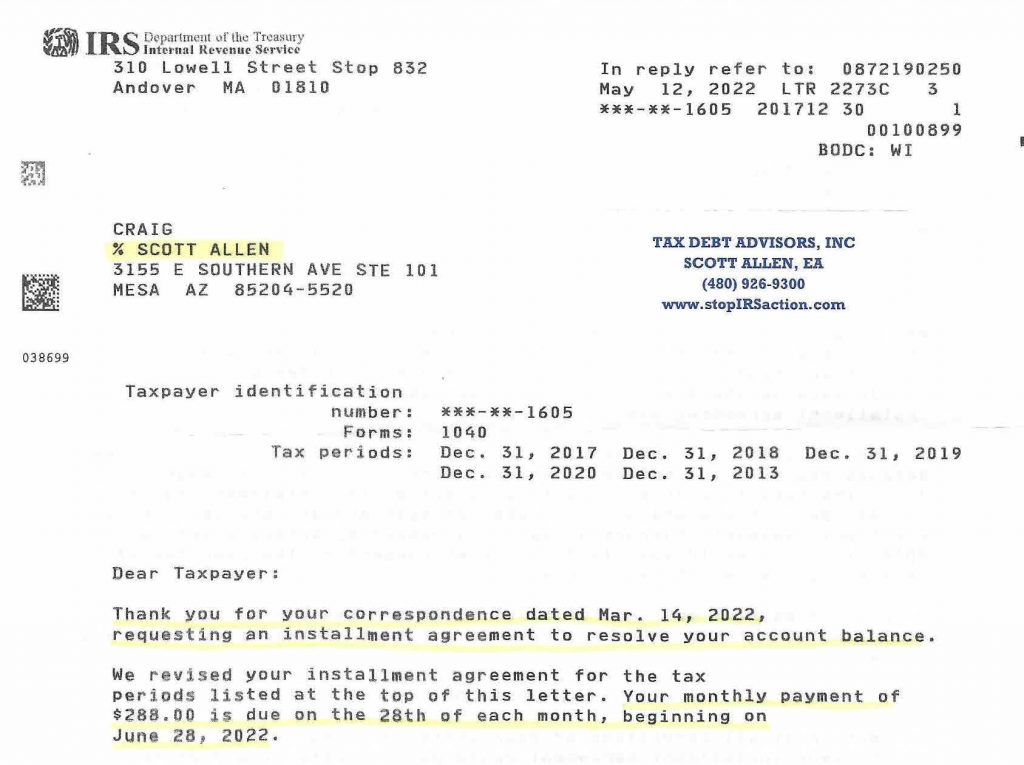

Below you will see a recent example of a successful negotiation by Scott Allen EA to resolve an IRS tax lien. Craig had a handful of tax years he owed back taxes on and needed to get all of them revised into one simple payment plan. Rather then hiring an expensive Scottsdale AZ IRS Tax Attorney he met with an Enrolled Agent who timely handled the matter so that the IRS tax lien didn’t turn into an IRS tax levy.