File Back Taxes Phoenix AZ in 2017

How to File Back Taxes Phoenix AZ Efficiently

When a taxpayer needs to file back taxes Phoenix AZ for a few years the last thing to do is “blindly” file them. Before preparing the tax returns it is imperative to have an IRS Power of Attorney representative such as Scott Allen EA contact the IRS in your behalf to confirm what is required to be done. Scott Allen EA will collect valuable information and records from the IRS that will assist in making sure the back tax returns are filed properly. In addition, Scott Allen EA will put a stop (or hold) on all collection activity so you do not get levied or garnished while going to the preparation of the tax returns.

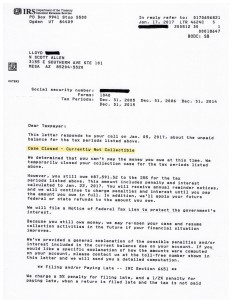

Below is a recent example this year of a client who had back tax returns to file. Upon getting the tax returns accepted a settlement negotiation was put into place. The taxpayer qualified for a currently non collectible status. Lloyd is not required to pay a nickle on his back tax debt as long has he remains in compliance. Compliance means that he will file and full pay all his future tax returns with the IRS.

If you need help with your back taxes and would like to get a settlement negotiation with the IRS call and schedule to meet face to face with Scott Allen EA. He promises to get you the best possible settlement allowable by law. A currently non collectible is just one of several ways to resolve an IRS debt.