File Phoenix AZ back tax returns

Have you ever received a bill from the IRS on Phoenix AZ back tax returns you did not file?

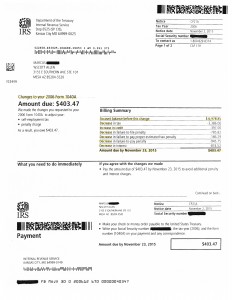

Well Marcus did and was he surprised to find out the IRS sent a levy notice to his employer. When Marcus came and met with Scott Allen EA of Tax Debt Advisors he had not filed tax returns in over 10 years and was under a wage garnishment. As of today Marcus is completely caught up on his Phoenix AZ back tax returns and on a negotiated payment plan with the IRS on a reduced amount. Below is a copy of a notice showing a successful reduction in tax debt for one of the years the IRS filed on behalf of Marcus. With the help of Scott he was able to protest their number with a correct and accurate tax amount saving over $6,000. This is just one a many examples of the excellent work Scott Allen EA can do for you if you qualify.

Many people who have Phoenix AZ back tax returns to file have no clue on where to even begin. Their tax records are either lost or in a box “far far away”. All is not lost and there are ways to accurately prepare of file those tax returns. Before beginning and tax preparation on any back tax returns Scott Allen EA will want to get an IRS power of attorney to represent you. With this he will be able to contact the IRS and put a hold to any collection activity and secure what records the IRS may have on you. If you have old tax debts he will find out what is owed and when do those debts expire. Yes, IRS debts have a statute of limitations. Don delay filing those back tax returns you know you need to get done. Find out that the process is actually easier then you might think.

Interested in seeing other successes of Scott Allen EA click here.

August 2018 update:

Jay and his wife have Phoenix AZ back tax returns that needed to be prepared and settled with the IRS. They owed the IRS for taxes from 2008 thru 2015. You can view that by clicking on the image below. That image is a copy of the IRS settlement negotiated by Scott Allen EA of Tax Debt Advisors. All that debt (over $100,000 of it) was settled into one monthly payment plan of $500. There are several ways or options to settle an IRS debt and its important to know about all of those options before negotiating one particular one.

If you have back tax returns that need to be prepared and then settled with the IRS give Scott Allen EA a call today. Year after year he has accomplished similar successes to this one.