IRS Audit Tempe AZ: Find help here

IRS Audit Tempe AZ help: Don’t delay the process

Being an American citizen we all will get audited at least once during our working years. If you are prepared; you should not have any fear. Dealing with an IRS audit Tempe should be more of an inconvenience then it is fearful. Scott Allen EA can help with that “fear factor” by making the audit process as convenient as possible for you. What is meant by the word convenient? By giving him an IRS power of attorney he can represent you by speaking and negotiating to the IRS directly for you. By allowing him this authority your fear level will drop.

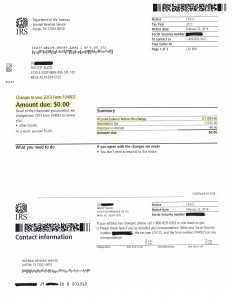

Below is just a small example of how Scott Allen EA of Tax Debt Advisors helped in a IRS audit Tempe for a current client. About a year after Liz filed and received her refund for tax year 2013 she received a proposed bill in the mail from the IRS for just over $1,000. This proposed bill came from information reported to the IRS that was not reported on her original filing. In 2013 she was forgiven of some debt by a creditor. This is a taxable event in most cases. Upon discussion Scott determined that Liz should not have to pay taxes on the debt forgiveness because she qualified to exclude it from income based upon an insolvency test. If a taxpayer is insolvent they are not required to pay taxes on forgiven debt up to that amount. It still has to be reported on her taxes; just as non taxable. Scott protested the IRS’s assessment of the tax with proper explanation and tax forms to justify it and got the proposed tax bill completely reduced to zero.

Don’t go at an IRS audit Tempe alone. Meet with Scott Allen EA for a free evaluation of your tax matter whether it be an audit, unfiled tax returns, or settling back IRS debt.