IRS payment plan Phoenix

Get help with IRS payment plan Phoenix

Consider yourself in good standing for finding the IRS help blog for IRS payment plan Phoenix. You may find yourself in a situation similar to Fred. When he met with Scott Allen EA he owed the IRS for a couple of years and had a few more that needed to be filed. This is a typical situation that Tax Debt Advisors deals with on a regular basis. It is important to remind yourself that you are not alone and that there is a way to a positive resolution. The IRS has the ability to lien, levy and garnish. However, they would prefer taxpayers to get back in compliance with their filings and work out a settlement. This is exactly what Tax Debt Advisors can do for you. By giving Scott Allen EA power of attorney to represent you he will get started on your case the very same day. Collection activity will stop and a road map to a resolution will be given.

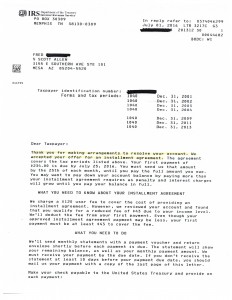

View the notice below to see the settlement that was achieved for Fred. He is currently on an IRS payment plan Phoenix for $234 per month. The IRS will leave him and his income alone as long as he sticks to his agreement.

When Scott Allen EA finishes up a case with a client he does not revoke his IRS power of attorney. He will leave it in the system so if an issue comes up down the road the IRS will also notify him of the problem so it can be address quickly. Let Scott Allen EA begin working your case today.

2020 IRS Payment Plan Phoenix

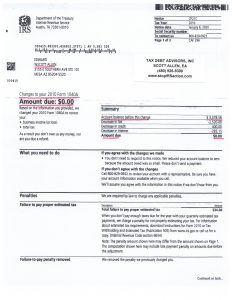

Before you begin the process of negotiating a payment plan with the IRS you first want to verify everything is in compliance. Part of compliance means that all of your tax returns are filed and filed properly. Edward came in to do exactly that. But upon an investigation, Scott Allen EA found out Edward had not yet filed his 2010 tax return. He owed taxes for that year but it was for a tax return the IRS prepared for him called “substitute for return”. By clicking on the image below you will see that we took the $3,378 tax debt down to ZERO with a proper taxpayer filed return. Now we can start on the payment plan work for him on his other remaining tax debt alone.

Consult with an experienced tax professional who handles the IRS on a daily basis. Scott Allen EA does just that. Call his office and speak with him today.