IRS Settlement – Case Closed in Mesa AZ

Would you like to have your IRS Settlement – Case Closed?

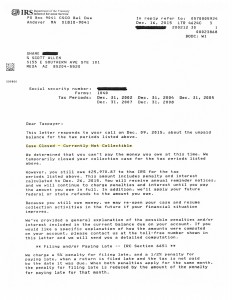

If you live near Mesa AZ and think you might qualify for an IRS settlement – Case Closed then give Scott Allen EA a call to schedule for a free evaluation. Shane met with Scott Allen EA and did exactly that. What does Case Closed actually mean? To find out more information click here.

What qualifies a person to qualify for an IRS settlement – Case Closed in Mesa AZ? First, all required tax returns must be filed. If there are any back tax returns that are unfiled Scott Allen EA will assist in that process. He can file all of your back tax returns even if you don’t have any records. As your IRS power of attorney he will be your representative before the IRS. Its important to remember that there isn’t just one IRS settlement option but rather about six different options. Getting a currently non collectible status is just one of those options. A currently non collectible status does not mean your IRS debt went away. It is still there, it still accrues interest, however the IRS cannot collect on it. Fortunately IRS debt have expiration dates and so some clients will stay in this status until their IRS debt expires.

Scott Allen EA will help you navigate your IRS situation to the best possible solution allowable by law. Every option has something good (and not so good) about it. It is important to know all of these so you can make an informed decision that you will feel good about. Scott Allen EA will make sure you feel relieved about your IRS settlement choice. Speak with him today.