IRS settlement Mesa AZ done properly

The proper way for an IRS settlement Mesa AZ

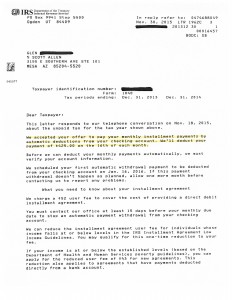

To insure getting the best possible IRS settlement Mesa AZ it is important to do your research. Be sure to hire someone local that you can meet with in person. Also, be sure the person that you meet with will be the same person who will be representing you and preparing your tax returns. You do not want to deal with a “sales person” who will say just about anything to get a commission. When you call Tax Debt Advisors you will speak with and meet with Scott Allen EA. They dont hire sales people and they are a family owned business since 1977 well onto their second generation of work. Scott Allen EA will handle your case from the initial consultation to the completed settlement work. This is exactly what he did for his client, Glen. This is not a boast, this is just providing evidence that Scott Allen EA is properly licensed to represent people before the IRS as a power of attorney and that he follows through to competition. View the settlement below.

What can qualify you for an IRS settlement Mesa AZ? There are a few requirement you have to meet in order to work out a negotiation with the IRS. First, you have to have all your back tax returns filed for. Second, you have to be and remain current on your 2016 taxes. And third, you cant owe taxes in the future. Doing so will cause the agreement to default and you have to being all over again.

Scott Allen EA can help you with all three of those steps. He promises straight answers and follow through service. If you cannot benefit from his services he will not take on your case. To speak with him today please call 480-926-9300.

Thank you.