IRS Tax Levy in Mesa AZ: Work with Tax Debt Advisors

IRS Tax Levy in Mesa AZ

One of the best ways to get your levy released is to request a meeting with a Manager if you are not successful working with an IRS Revenue Agent. The next course of action is to request a Collection Due Process hearing with an Appeals Officer.

If you filed for bankruptcy before the IRS issued the levy, a manager or appeals officer will release the levy. Occasionally, the IRS will correctly issue a levy, but when the statute of limitations is over, the levy still exists. Again, a manager or appeals officer will release the levy once the statute of limitations has expired.

If you have an accepted proposal to enter into a payment plan, the IRS will immediately release your IRS tax levy in Mesa AZ. Remember the IRS is not there to advise you of all of your settlement options; they are a bill collector. It is best to retain the services of an IRS professional before you enter into any settlement with the IRS.

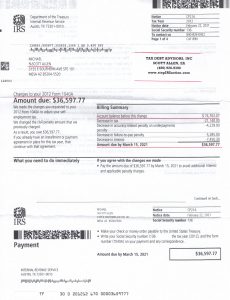

Scott Allen E.A. of Tax Debt Advisors has expertise to negotiate with the IRS on your behalf. Tax Debt Advisors in Mesa AZ offers a free initial consultation and can be reached at 480-926-9300 to schedule an appointment.

See a recent success by Scott Allen E.A. of Tax Debt Advisors challenging and protesting the IRS on an old 2012 debt. The taxpayers debt was reduced by over $38,000!