Is a Phoenix AZ IRS Tax Attorney needed for the Collection Appeals Program (CAP)?

Phoenix AZ IRS Tax Attorney

No, you do not need a Phoenix AZ IRS Tax Attorney to participate in the IRS Collection Appeals Program or CAP. The CAP was set up to help taxpayers before or after the IRS files a Notice of Lien, before or after the IRS seizes or levies property, bank accounts or payroll checks, or if the IRS rejects or terminates your installment arrangement.

The IRS is required to allow you to have a hearing regarding your position with the Appeals Office. The IRS cannot enforce collections action before giving you this right. Your hearing with the Appeals Office is before an impartial person who has not previously been involved in your case. This is not a legal matter and does not require an IRS Tax Attorney in Phoenix AZ.

Scott Allen E.A. has successfully negotiated settlements with the Appeals Office. Options may include but are not limited to installment agreements, non-collectible status, offers in compromise, and innocent spouse status. Call Scott today at 480-926-9300 and schedule a free consultation to see what options are available to you.

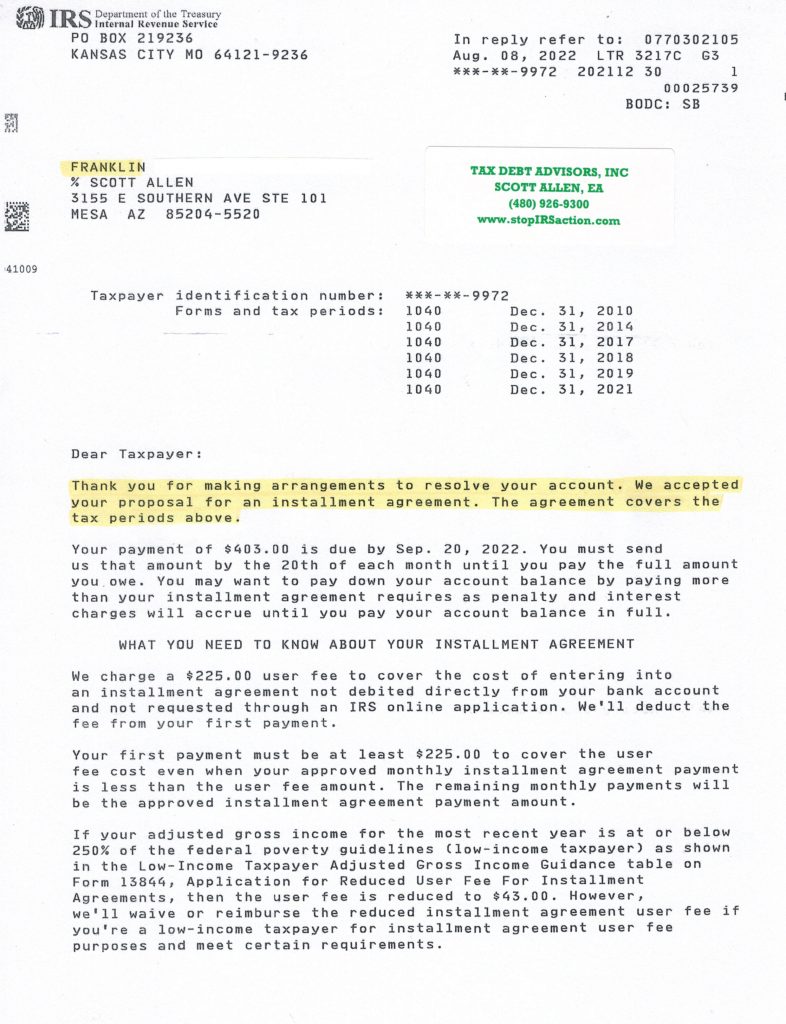

Scott Allen EA was able to help out Franklin with his IRS tax debt matter. He did not need to hire a Phoenix AZ IRS Tax Attorney or even file a CAP. What he needed was a quick negotiation of an installment arrangement. This put a stop to all collection activity and got him compliant with the IRS. Again, avoid getting fearful of the IRS and avoid costly mistakes that come from that fear. View the IRS letter below to see what Scott Allen EA did for Franklin of Phoenix AZ on his back taxes.