Mesa AZ IRS Offer in Compromise

View an accepted Mesa AZ IRS Offer in Compromise below

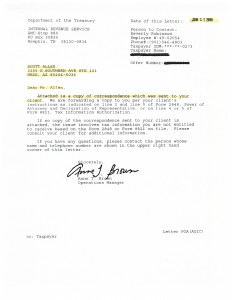

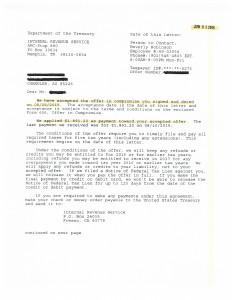

Scott Allen EA of Tax Debt Advisors successfully negotiated a Mesa AZ IRS Offer in Compromise for one of his clients. This client came in owing the IRS $334,340.83 for 2009, 2010, 2011, 2012, 2013, & 2014. An Offer was submitted in August 2015 for $9,456.00 to settle the debt in full. That is about 2.8 cents on the dollar. As required they submitted the offer with the 20% down payment of $1,891.20. The remaining 80% is due upon acceptance. View the two pages below showing Scott Allen EA as the taxpayer’s Power of Attorney and the IRS approving and accepting the Offer in Compromise submitted.

The most difficult part to an IRS Offer in Compromise is qualifying for it. Taxpayers will come in and visit with Scott Allen EA thinking they can shop for an Offer with the IRS. Contrary to advertisements on the TV, internet, and radio this isn’t the case. Only about 2-3% of taxpayer are even a candidate to settle their debt through an Offer in Compromise (aka “fresh start program”). This option is only one of the six different settlement options available to you. Its important to understand and review all options before considering an Offer in Compromise. After its been determined that you are in full compliance with the IRS and that you are a viable candidate for an IRS Offer then Tax Debt Advisors will take you down that road step by step. They will only take on your case if it is in your best interest. To get your IRS debt situation evaluated with Scott Allen EA give him a call today at 480-926-9300. He will make today a great day for you.

Tax Debt Advisors, Inc is a local family owned and operated business since 1977.