Offer in Compromise using a Scottsdale AZ IRS Tax Attorney: Is it best for you?

Is a Scottsdale AZ IRS Tax Attorneys better at filing an IRS Offer in Compromise.

Apparently taxpayers need to be careful not to rely on the title “attorney” when retaining one to file an offer in compromise. Three of the largest companies representing taxpayers–JK Harris, Tax Masters and Roni Lynn Deutch have all filed bankruptcy and shut their doors leaving hundreds of thousands of taxpayers stranded without resolving their IRS matter and unable to refund their money. All of these firms and many like them all advertised using Arizona IRS Tax attorneys. The same is true of most if not all “out of state” companies and companies with 800 numbers that tout the same lies and dupe taxpayers out of outrageous amounts of money and provide no service–ZERO !

The latest firm to go under, Roni Lynn Deutch, Governor Jerry Brown called her operation a “heartless scheme.”

A former employee said, “In the entire time I worked for RONI DEUTCH I never saw a client of mine or any of my associates get approved for an OIC. I did see several clients drop kicked for various BS after they paid. Once the money was in no one cared what happened to the client.”

Another employee had this to say, “the truth is I was one of Roni Deutch’s “Tax Directors” and I have read the complaint AG Brown filed. It is all true. I was trained (by Russel Deutch) to “Help” clients do the math so they would appear to qualify for an OIC. Made up expenses like child care paid to a “relative” or extra cords of wood in the winter to supplement energy costs, ask any former “Tax Director” and they will all tell the same story of scam after scam. I gave sworn testimony in the New York case; I sure hope I get the chance to testify against this dirt bag again.”

And finally, one more employee said, “Roni pays big, big bonuses for exceeding quota. (at least she did while I worked for her) No one cared how you did it while I was there; as long as the $$$ rolled in it was all Las Vegas and Cocaine …..if you were in the right crowd, or so I’ve heard.”

So when it comes time to consider who to choose to represent you be sure to select someone who you personally meet. Not every Scottsdale AZ Tax IRS Attorney is a schemers but to rely on the title IRS Tax Attorney in Scottsdale can be one of the biggest mistakes you can make about who represents you before the IRS. Our recommendation is that you schedule to meet with Scott Allen E.A. He can be reached at 480-926-9300. He offers free consultations to meet with you and discuss what you may and may not qualify for settlement. So, before meeting with an IRS Tax Attorney Scottsdale, AZ in the areas of 85256, 85260, or 85251 call Scott with Tax Debt Advisors, Inc. We are a company with over 40+ years of experience of dealing with the IRS and filing acceptable IRS Offer in Compromises.

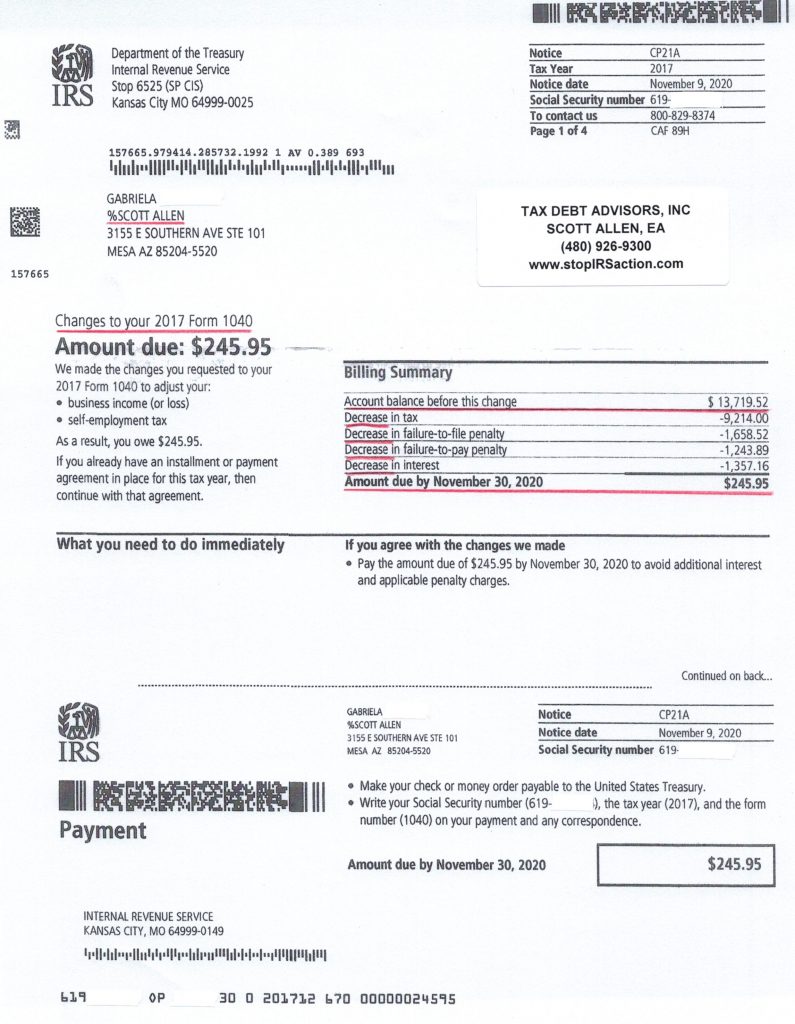

See a recent success of Scott Allen EA

Below is a letter directly from the IRS of Scott Allen EA saving a client over $13,000 in taxes on a 2017 tax return.