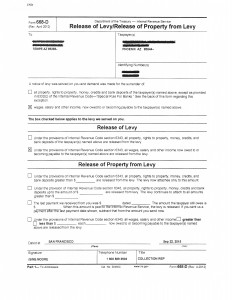

Phoenix AZ IRS wage Garnishment Release Notice

If you click on the picture below you will find a notice of Phoenix AZ IRS wage garnishment release. Another mission accomplished for Scott Allen EA and Tax Debt Advisors. This IRS wage garnishment was released last week within 5 hours of the taxpayer notifying them.

As we are all victims of at times, we procrastinate what we know we need to do whether it be mowing the lawn, emptying out the dishwasher, or settling up with the IRS. However, when you put off mowing the lawn, it just grows longer and maybe you get a few weeds. But when you put off filing back taxes or settling IRS debt they can and will issue you a Phoenix AZ IRS wage garnishment notice. When this happens the IRS will take anywhere from 20-80% of your net wages until you resolve the matter. Your employer is required by law to respond to their request.

Items that may need to be taken care of to permanently release an IRS wage garnishment are:

Scott Allen EA has been successful getting temporary stops to IRS wage garnishments in Phoenix AZ with making strong commitments to getting the two steps accomplished. However, if you have already been given several opportunities to resolve it or have already asked for IRS garnishment releases in Phoenix AZ before then they may be limited on what they can do for you right away. Remember you DO NOT have to file bankruptcy to stop an IRS garnishment. There are other resources. Talk with Scott Allen EA in the Phoenix Arizona area today to evaluate all your available options. His family company has been releasing IRS garnishments since 1977. Put their experience to work for you.

Click here to contact him.