Reduce IRS Debt in Mesa AZ by Scott Allen EA

Mark was able to reduce IRS debt in Mesa AZ through audit reconsideration

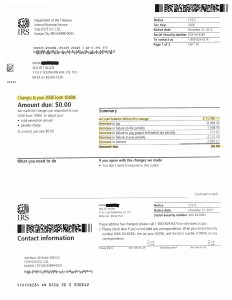

Check out the notice below to see the work accomplished by Scott Allen EA of Tax Debt Advisors. Scott was hired by the taxpayer to be his IRS power of attorney. You will find Scott’s name listed right under the taxpayers name that is blacked out. See what he was able to accomplish for Mark to reduce IRS debt in Mesa AZ.

There may be multiple ways to lower your tax burden to the IRS. Most of the taxpayers who meet with Scott Allen EA have back tax returns that need to be filed. His average clients has not filed in about 4-7 years. The surest and most effective way to keep your tax debt as low as possible is to prepare and file your back tax returns aggressively and accurately. The lower your overall tax bill is the less interest and penalties the IRS can charge you.

Before filing any back tax returns Scott Allen EA will be getting an IRS power of attorney to represent you from beginning to end. With this authorization he will immediately get in contact with the IRS in your behalf. Doing so will get him on board to put a stop to all collection activity and to gather up all the necessary information to aggressively and accurately file the missing tax returns.

Typically with unfiled tax returns you will begin with the earliest year first. Start there and make your way up through 2015. Once you are in compliance with your tax filings you can begin to work out an IRS agreement or settlement. click here to see the different settlement options available to you.

If you are considering to hire a representative or firm that is out of state I caution you against that. Don’t put your money and finances in the hands of an out of touch person who you cannot meet with face to face. Local is always better…every time.

Thank you.

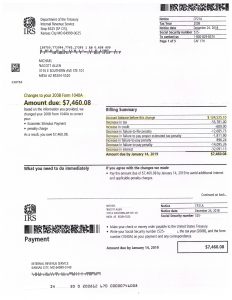

January 2019 Case Resolution:

Ever get a tax assessment from the IRS and have no clue how they can claim you owe more in tax then you had in income? If you have lost sleep over this you are not alone. The IRS has the ability to file tax returns if you fail to do so. They file these SFR returns if a return becomes delinquent beyond two years of the due date. Mike was a struggling taxpayer in this situation. He didn’t just have one delinquent but had over ten years of delinquent returns and the IRS filed SFR returns on him for seven of those years. Scott Allen EA had his work cut out for him on this case but was able to represent him as his IRS power of attorney and Reduce IRS debt Mesa AZ for him. Check out the amazing IRS notice below. This is just one crazy reduction of IRS debt, interest and penalty for one of his tax returns.

If you have a large IRS debt consider speaking with Scott Allen EA of Tax Debt Advisors for a consultation.