Saved nearly $3,000 in Mesa IRS Debt

What options are available to those with Mesa IRS debt?

First, it is important to start off that everyone’s tax matter is different and wll most likely have a different outcome. With that being said there is always an option available to deal with Mesa IRS debt. Options can include:

- Amend a tax return

- Apply for audit reconsideration

- Negotiate a payment plan

- Point out an IRS error

- Negotiate a currently non collectible status

- Apply for an offer in compromise

- Request a 60 day payoff letter

- File an IRS Form 911 requesting advocate service on a specific issue

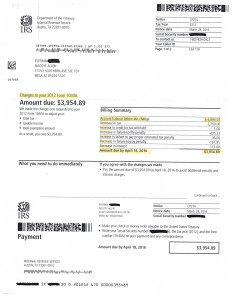

For Esteban, Tax Debt Advisors applied for an audit reconsideration on a SFR tax return the IRS filed against him. They did not give him credit for proper deductions and exemptions. Through preparing a proper and accurate tax return Tax Debt Advisors was able to reduce his Mesa IRS Debt by nearly $3,000. View the actual notice below to see the results.

If you think you could benefit from the services of Tax Debt Advisors contact them today. Ask to speak with Scott Allen EA who will personally handle your case from beginning to end.