Scott Allen E.A. can release Mesa Arizona IRS Wage Garnishments or Bank Levies

How can Mesa Arizona IRS Wage Garnishments be stopped?

If you have an IRS tax liability and have ignored or been unaware of their attempts to collect the balance due, the IRS in Mesa AZ will eventually garnish your wages or levy your bank account. The remedy is to first file all unfiled returns and petition the IRS for a settlement. This process requires the use of an IRS professional with expertise in filing returns and negotiating the best settlement option. May I suggest you consider calling Scott Allen E.A. for a free appointment at 480-926-9300? Scott will make sure you understand all of your options. Usually it is obvious that one option is much better than all the others. On occasion the best strategy will include using 2 or 3 options to arrive at the best settlement option.

If you want to get the best settlement and have your Mesa Arizona IRS wage garnishments stopped or bank levy released call Scott Allen E.A. today. He will make today a great day for you!

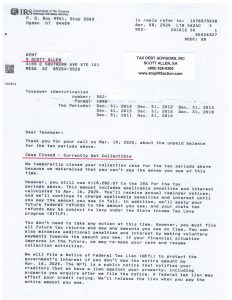

See a recent example below of how Scott took aggressive action for a client to stop IRS collection activity. This is an agreement between a client and the IRS of an non collectible status.