Scott Allen EA can realease an Arizona IRS Levy

How Scott Allen EA Can Release an Arizona IRS Levy

If you’re facing an Arizona IRS levy, you may be wondering how you can get it released. The good news is that there are a number of things you can do, and Scott Allen EA can help.

In this blog post, we’ll discuss what an IRS levy is, what causes it, and how Scott Allen EA can help you get it released.

What is an Arizona IRS levy?

An Arizona IRS levy is a legal process that allows the IRS to collect taxes by seizing your property. This can include your bank accounts, wages, and even your assets, such as your car or home.

The IRS can issue a levy if you owe taxes and have not made arrangements to pay them. They can also issue a levy if you have failed to file your tax returns.

What causes an IRS levy?

There are a number of things that can cause the IRS to issue a levy. These include:

- Not paying your taxes

- Not filing your tax returns

- Failing to make arrangements to pay your taxes

- Having a history of non-compliance with the IRS

How can Scott Allen EA help?

If you’re facing an IRS levy, Scott Allen EA can help. We can:

- Represent you in negotiations with the IRS

- Help you develop a payment plan

- File your tax returns

- Help you resolve any other issues that may be causing the IRS to pursue collection

We understand that dealing with the IRS can be stressful and overwhelming. That’s why we’re here to help. We’ll work with you every step of the way to get your levy released and get your financial life back on track.

What are the steps involved in getting an Arizona IRS levy released?

The steps involved in getting an IRS levy released will vary depending on your individual circumstances. However, there are some general steps that may be involved:

- Contact the IRS and find out why the levy was issued.

- Make arrangements to pay the taxes that are owed.

- File any outstanding tax returns.

- Request that the levy be released.

The IRS may require you to provide additional information or documentation before they will release the levy. This could include things like proof of income, bank statements, or proof that you have filed your tax returns.

Once you have provided all of the required information, the IRS will review your request and make a decision about whether to release the levy. If the levy is released, the IRS will send you a letter confirming this.

What are the consequences of not getting an IRS levy released?

If you do not get an Arizona IRS levy released, the IRS may continue to seize your property. This could include your bank accounts, wages, and even your assets, such as your car or home.

The IRS may also take additional collection actions, such as garnishing your wages or putting a lien on your property.

If you are facing an IRS levy, it is important to take action to get it released. Scott Allen EA can help you with this process.

Contact Scott Allen EA today to get started

If you are facing an Arizona IRS levy, contact Scott Allen EA today to get started. We can help you get your levy released and get your financial life back on track.

We offer a free consultation, so there is no risk in contacting us. We’ll review your situation and discuss your options. We can also help you develop a payment plan that works for you.

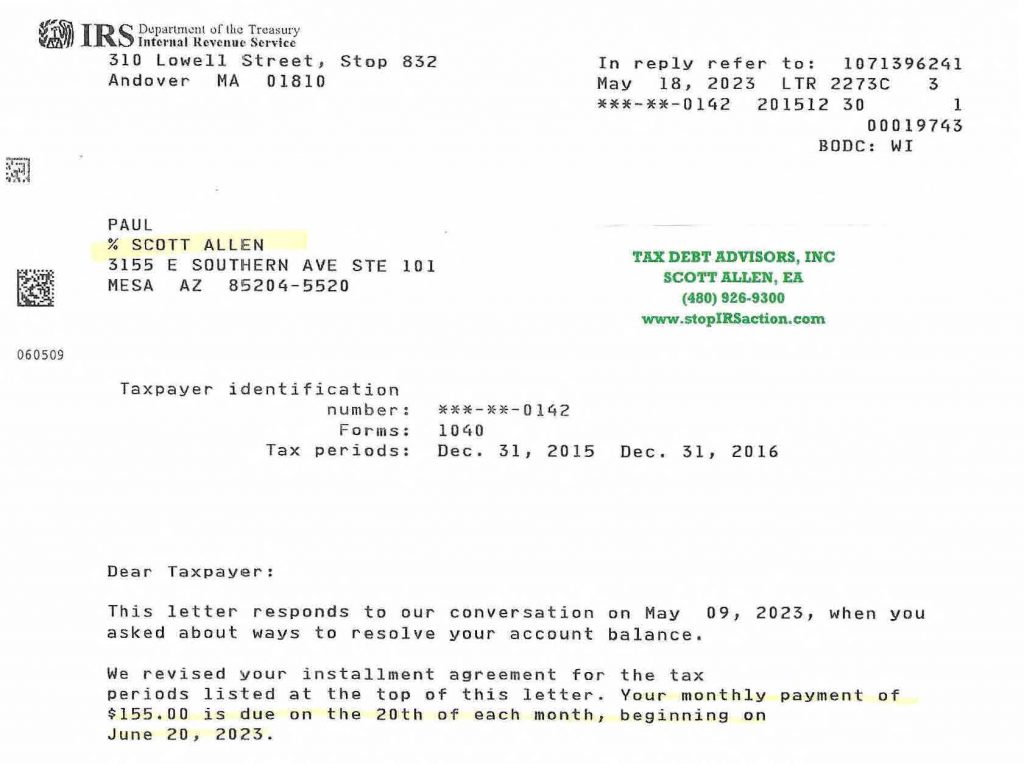

Don’t wait any longer. Contact Scott Allen EA today to get started. See below how he helped out his client Paul by negotiating his back taxes owed into a low monthly payment plan. This agreement stopped the IRS levy and got him back in good standing again.