Scottsdale AZ IRS Settlement: 2016

Find out what your Scottsdale AZ IRS Settlement is

There are several ways to get a Scottsdale AZ IRS settlement. Some of those settlement options include:

- Currently Non Collectible status

- Installment Arrangement

- Offer in Compromise

- Chapter 7 & Chapter 13 bankruptcy (Yes, taxes can be discharged)

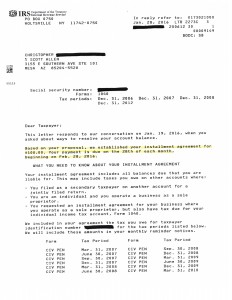

For Chris his Scottsdale AZ IRS settlement was a $100/month installment arrangement. Chris has some personal 1040 back tax debt and also some civil penalty tax debt from an old business venture. All of it is part of the $100/month installment arrangement. Now he is continuing on with his new business not letting this tax matter keeping him from pursuing his new business dream.

Who is Tax Debt Advisors, Inc?

Tax Debt Advisors, Inc is an Arizona based family company. It is currently owned and operated by Scott Allen EA. Scott purchased the business in 2007 from his father who started resolving IRS problems in 1977. When his father moved to the Phoenix/Scottsdale area he discovered the need in the marketplace for IRS problem help. Their average client has not filed back tax returns in about 4-7 years and/or owes the IRS more then $50,000. Its important that the company you hire has experience in the IRS problem niche. This is all that Scott Allen EA of Tax Debt Advisors does. Put him to work for you. With him as your IRS power of attorney you will never have to speak to the IRS again. Talk with him today about your specific needs.