Settle IRS Debt in Mesa AZ: Revised

Have you considered revising your agreement to settle IRS debt in Mesa AZ?

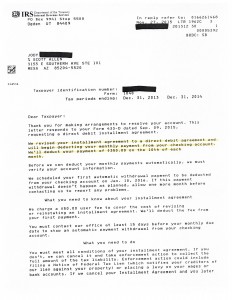

This is what Jody decided to do. He came in to met with Scott Allen EA to get his IRS payment plan adjusted. View his new IRS agreement below.

What options are there to settle your IRS debt? Typically there are six different ways. The list below will go over what those options are. Click on them to read further details.

1. Let it expire

2. Suspend it

3. Adjust it

4. Pay it

5. Compromise it

6. Discharge it

For Jody his best solution was #4. For you it may be a different option or utilizing more them one option before the debt gets settled. If you view option #6 you will see the different bankruptcy options to settle IRS debt in Mesa AZ. Probably most people that meet with Scott Allen EA are unaware that their IRS debt might be dischargeable under Chapter 7 or Chapter 13 bankruptcy. To evaluate that option consult with Scott Allen EA today. Another option people are often unaware of is #1. Did you know IRS debt has an expiration date? Yes, the IRS only has so long to collect your debt. Many clients let the debt expire and never pay a dime of their remaining debt.

Don’t get into a settlement option with the IRS without evaluating all six different solutions. That is what Scott Allen EA will do for you. Contact him today to schedule a time to meet and get the process started. 480-926-9300