Settle IRS Debt Tempe AZ right now

Just like Earl you too can settle IRS debt Tempe AZ today.

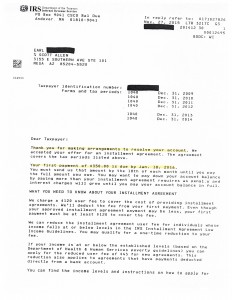

Everyone’s tax and financial situation is completely different. Scott Allen EA has never had two identical cases. However, all of his clients can settle IRS debt Tempe AZ with proper representation. Read the notice below and see the success he had with his client Earl.

When Earl came in to meet with Scott Allen EA of Tax Debt Advisors he was working two jobs while one of them was under an IRS wage garnishment. He was barely making ends meet without the garnishment now it was becoming impossible. After consulting Scott Allen EA got on the case. With a form 2848 power of attorney authorization he was able to speak with the IRS and negotiate a temporary release of the wage garnishment. This allowed Earl and Scott time to prepare three years of Tempe AZ back tax returns and to negotiate a settlement with them. After evaluating his financial status, bills, and debts it was determined that the best option for him was a $350 per month payment plan. This will make the stop to wage garnishments permanent and he also qualified to not have a federal tax lien filed on his credit. Good work for Scott Allen EA and his client Earl.

To evaluate your options with Scott Allen EA contact his office today to set up a time to meet. He will make today a great day for you.