Stop IRS levy in Mesa AZ today.

Find out today if you qualify to stop IRS levy in Mesa AZ. Its always best to resolve your IRS matter before they resort to levy action either to your bank account or wages. However, if they do all is not lost. There are options to stop IRS levy in Mesa AZ. Call and speak with Scott Allen EA today at 480-926-9300.

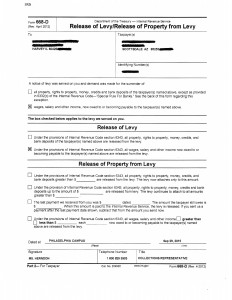

To briefly sum up what happened with this taxpayer. Last week he called and talked with Scott Allen EA about 11:30am in a panic. He had just found out 10 minutes prior that his wages were going to be garnished by the IRS. Payroll was set to be issued by 2:00pm the same day. All of the company’s payroll is done out of Illinois. Scott Allen EA told the client to come on down with the payroll departments information so IF a stop of the IRS levy is possible it can be sent right over via fax. Scott nor anyone can guarantee an immediate stop to the IRS levy in Mesa but will do any negotiating possible to get that relief. Long story short Scott Allen EA was able to get the levy release for the client. A copy of the release was faxed to Scott Allen EA’s office along with a copy sent to the taxpayers payroll department by 1:52pm. Just barely in time for them to not levy his next paycheck. In this email is a copy of that release.

Its important to remember that this is not the end of the road for the taxpayer. This is actually just the beginning. He has some unfiled tax returns that need to be prepared and will also need to get into a permanent agreement with the IRS to prevent future levies from happening. As of today Scott Allen EA is working with the client closely to get those tax returns prepared as quickly as possible. If the client does not meet the agreed terms then the IRS can place the levy back on his wages and they will most likely keep that there until he is in full compliance with the IRS which can be difficult to accomplish with the IRS taking 60% of his paycheck. If you need stop IRS levy in Mesa AZ Scott Allen EA should be your stop. He has the aggressive tools to work with the IRS and get you the best possible settlement allowable by law.

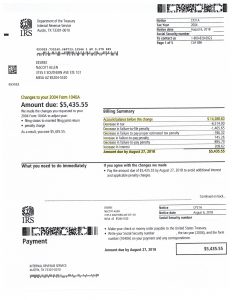

August 2018 update on Stop IRS Levy in Mesa AZ for a new client:

The above taxpayers were facing a levy from the IRS on a very old tax debt. This debt was from a tax return that the IRS filed (not the taxpayers). This created a very large balance due with additional interest and penalties. In discussion with the clients it was determined that the best solution to stop IRS levy in Mesa AZ was to prepare a correct tax return showing the IRS the more accurate liability and negotiating an agreement on the smaller amount. Just by preparing a proper tax return it saved the clients over $8,800. The less someone owes the IRS the less aggressive they are.

Meet with Scott Allen EA if you feel the IRS is being too aggressive with your case. He will help you discover the best possible solution.