Tax Debt Advisors can stop Tempe AZ IRS Wage Garnishment

Don’t let a Tempe AZ IRS Wage Garnishment happen to you.

IRS wage garnishments in Tempe AZ are stopped by paying off the tax debt, entering into an IRS settlement or proving you do not owe the tax liability. Some of the IRS settlements that will stop an IRS wage garnishment include:

- Agree to a month payment plan on the balance you owe.

- File a legitimate Offer in Compromise

- Qualify for a Non-Collectible Status

- File bankruptcy

- Take matter to the IRS Office of Appeals

Each of these options requires professional assistance to get the best result as quickly as possible. Scott Allen E.A. of Tax Debt Advisors has the expertise to negotiate on your behalf the option that is best for you. Tax Debt Advisors offers a free initial consultation and has been representing taxpayers on IRS wage garnishments since 1977. Schedule your appointment by calling him at 48-926-9300.

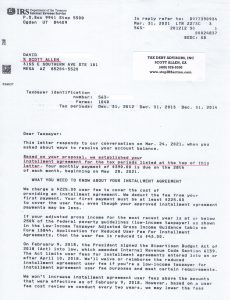

View a recent IRS settlement below for a taxpayer in Tempe AZ.

0