Tax Debt Advisors Inc provides IRS garnishment Relief Mesa

IRS Garnishment Relief Mesa

Scott Allen E.A. of Tax Debt Advisors in Mesa AZ has helped hundreds of employees get a release of their garnished wages. Employees of Bank of America, Intel and JPMorgan Chase have used our services. Don’t wait until the IRS decides to levy your Mesa Arizona bank accounts as well. Tax Debt Advisors offers a free initial consultation and can be reached at 480-926-9300. Remember that there are several options available to get IRS garnishment relief Mesa. Don’t wait until your options are limited by IRS action.

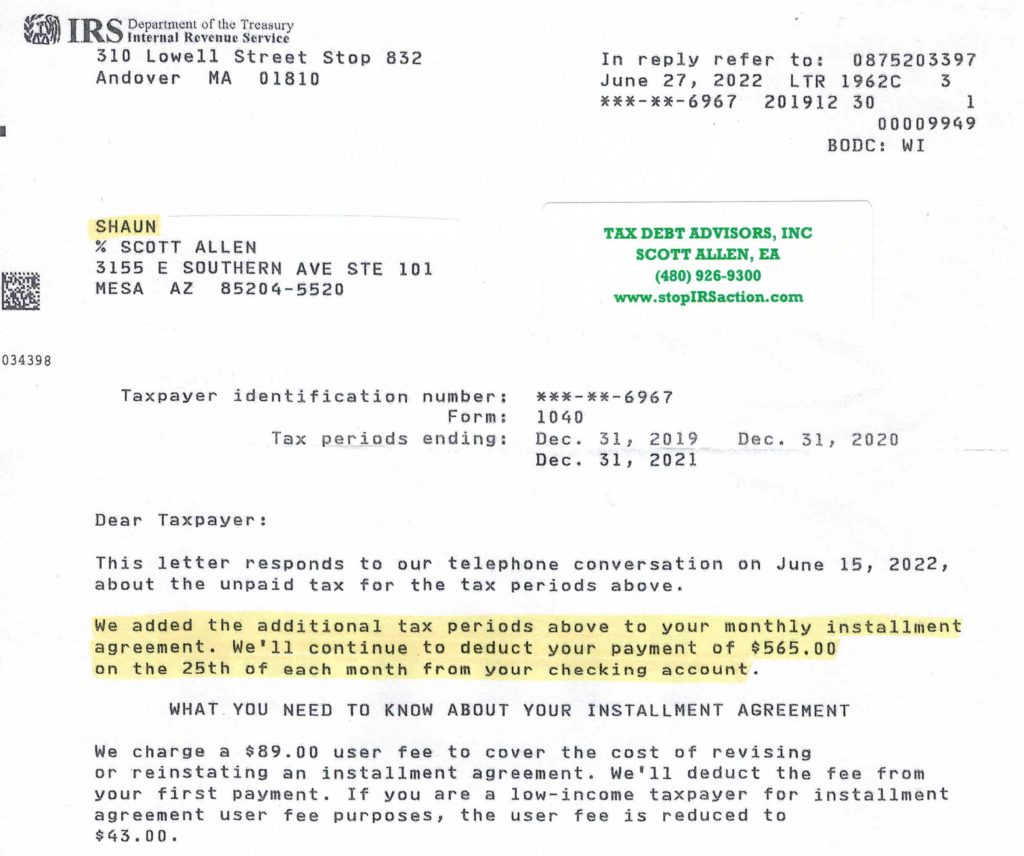

See below how Scott Allen EA was able to provide IRS garnishment relief Mesa for his client Shaun. Shaun had his payment default and on the verge of a levy or garnishment because he did not pay his 2021 taxes on time per the agreement. Scott was able to step in and renegotiate his agreement with the IRS and include the 2021 tax debt into that plan. This stopped all collection activity from the IRS.