Tax Debt Advisors, Inc.—What do I do if I default on my Chandler AZ IRS Installment Arrangement?

Help with Chandler AZ IRS Installment Arrangement

If you do not make a monthly payment or if your check does not clear, the IRS will send you a default notice. If this is your first default and you have the ability to catch up on your missed payments including your current payment, call the IRS as soon as you get this notice and they will likely reinstate your IRS payment plan. They may require future payments by debiting your checking or savings account to make sure you give them priority over other debts.

There may be a silver lining in your default. Perhaps you really qualify for a lower IRS payment. If you negotiated you own payment plan, the IRS is just another bill collector doing their job. You may not have been aware of all of the obligations that the IRS needs to consider before coming to an amount that needs to be paid monthly. Scott Allen E.A. of Tax Debt Advisors, Inc. near Chandler Arizona offers a free initial consultation to advise you on what he can do you remedy the situation—lower your monthly payment or advise you to consider other IRS settlement options. Call today at 480-926-9300 to schedule an appointment.

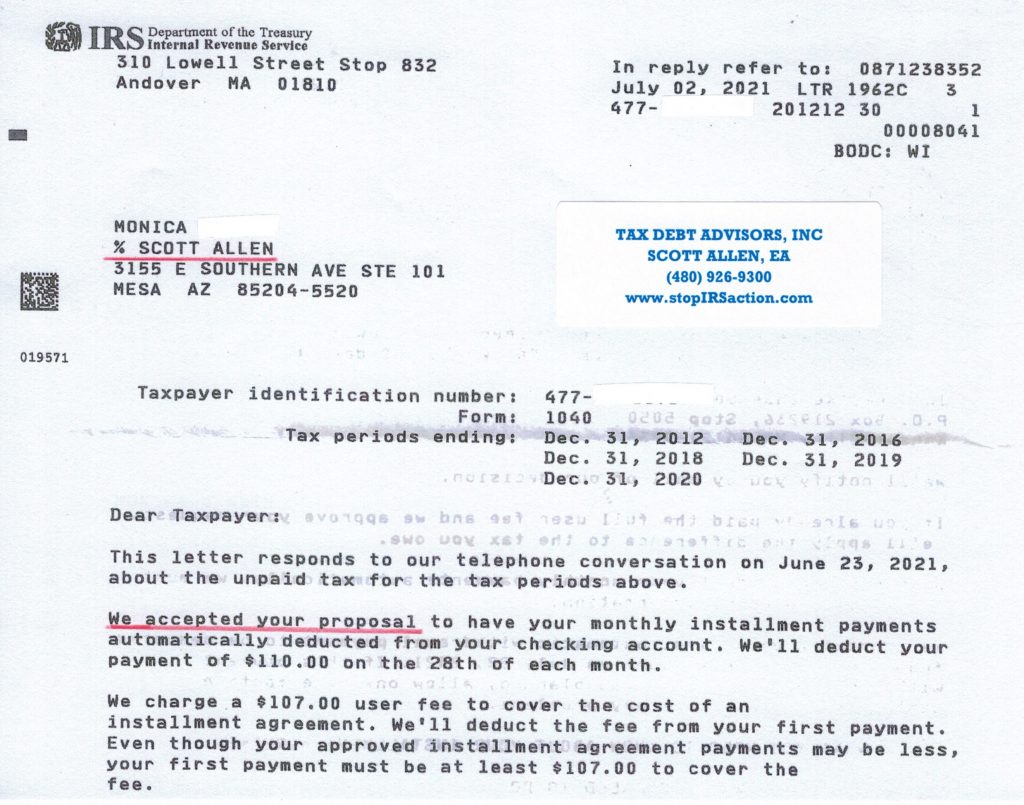

View a recent Chandler AZ IRS installment arrangement negotiated by Scott Allen EA. He got five years of IRS debt put into a low monthly payment plan of $110/month. Monica was thrilled. You can be thrilled too. Call Scott and let him file your back taxes and negotiate the best possible settlement allowable by law for you.