Tax Debt Advisors will release your IRS Federal Tax Garnishment in Glendale Arizona

It’s time to negotiate an IRS payment plan

Receiving the envelope from the personnel office that your wages have been garnished and 80% of your paycheck is gone is shocking to say the least. Financial troubles will mount quickly until you get your IRS tax garnishment released. One of the best and quickest ways to get your Glendale AZ wage garnishment released is to agree to an IRS installment arrangement which is a monthly payment plan. The amount of an installment arrangement is much less than an IRS garnishment.

This is not your only option to release your tax garnishment. Others include Innocent spouse relief, filing an Offer in Compromise, qualifying for non-collectible status or filing for bankruptcy. Scott Allen E.A. of Tax Debt Advisors can help you decide which option is best for your specific circumstances. Tax Debt Advisors has helped employees at Luke Air Force Base, Catholic Healthcare West and Arizona Public Service with their IRS wage garnishments. You can schedule a free initial consultation by calling 480-926-9300.

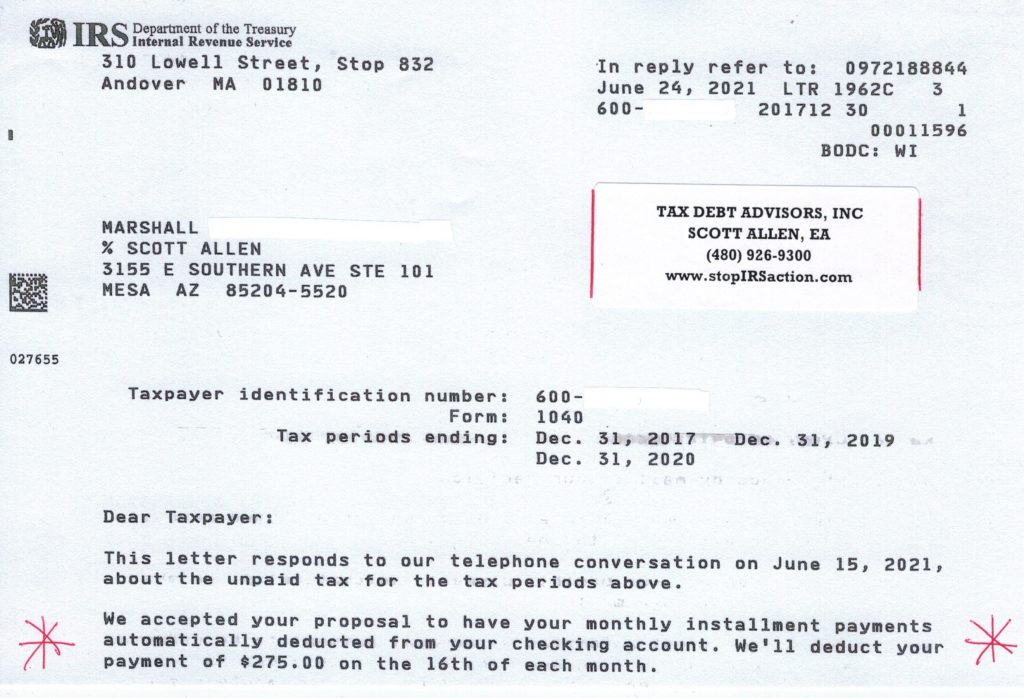

Marshall was in a situation with the IRS where he was receiving constant notices from the IRS threatening to drain his bank account and/or levy his wages. Scott Allen E.A. was able to stop the IRS from doing that and establish a very reasonable $275 a month payment plan.