Tax Debt Advisors will release your Mesa AZ IRS Wage Levy

Mesa AZ IRS Wage Levy: Get it released today!

A Mesa AZ IRS wage levy can take a significant percentage (60-80%) of your paycheck depending on your particular circumstances. Employers are afraid not to comply immediately with the Mesa levy notice. Technically they can be responsible for the amounts they should have sent to the IRS. The IRS will not release the Mesa AZ wage levy until:

Seriously consider the services of an IRS tax professional that has expertise with a Mesa AZ IRS wage levy. Scott Allen E.A. of Tax Debt Advisors has the experience to resolve your IRS wage levy in Mesa Arizona and offers a free initial consultation. Tax Debt Advisors can be reached at 480-926-9300. Their 40+ years of releasing IRS wage levies in Mesa AZ will benefit you quickly with the best settlement option allowed by law.

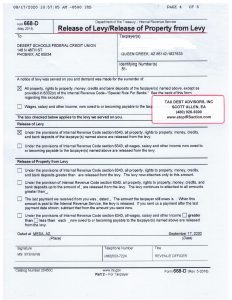

See a recent success of Tax Debt Advisors stopping a Mesa AZ Wage Levy for a client

Client on the image below to view